Today I’m going to show you how to flip houses quickly and repeat–creating a pattern and a rhythm so that you can flip fast and make money even faster (and repeatedly).

But….before we dive into that, quickly let me recap from my previous post. When we last met, we introduced the necessary steps to striking a deal with the seller. We talked about how to proceed with deals when the bank is the owner. Then we got into pulling comps and establishing values.

Starting to ring a bell? Good.

But that’s just a glimpse back in time, so I encourage you to rewind and start from the beginning if you need a refresher.

Okay. Ready or not, we’re moving on to tackle the art of the quick sell…

Steps to Sell

Build Your Buyers List

If you want to sell quickly to investors or rehabbers, you need to build a buyers list.

The best way to do this is to turn to the list – Craigslist that is. I know, I know – it has a bad rap for some things, and even listings in particular, but for our purposes, Craigslist is a winner. So use it to list your properties – multiple properties at a time – to attract those hungry investors.

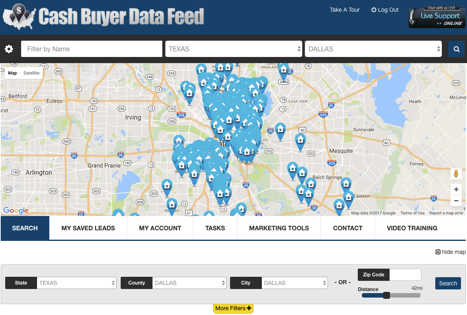

Personally, I use my Cash Buyer Data Feed system to help build my own cash buyers list every single month. It’s fast, super affordable and hands you known cash buyers on a silver platter! In fact, if you haven’t already tried it, you can run a quick search completely FREE by clicking here!

For instance, if I am investing in Dallas, I can log in and find all the known cash buyers for my deals just like you see above!

LinkedIn is another great online networking tool.

Oh, and don’t forget about good ‘ole bandit signs. Some consider them old school, but they work – very well, in fact – so place them strategically in high traffic areas with good visibility, where investors will see them and be sure to use strong (bold and brief) language to reel them in and get the phone ringing.

Now, if you’re freaking out about building a buyers list, don’t!

Now, if you’re freaking out about building a buyers list, don’t!

Just relax because you only need a handful of buyers to get started. (If you’re talking high volume, though, then that’s a horse of a different color for a different post). If you’re placing your ads effectively and in the right places where investors will see them, you should receive lots of calls from interested buyers.

Remember to prescreen these guys and gals to make sure they can close quickly, and use a script so you remember to ask the right questions and stay in control of the conversation. Then make sure that you are prepared with the right answers.

Being a rookie is ok, but you’ll want to make sure you don’t sound like one.

Pro Tip: The key to prescreening is to ensure your buyers can close BEFORE your contract expires.

You might be wondering, “Can you ask you seller for an extension?”

Yes. But it’s not ideal. So make sure that whenever possible, your buyers have the cash up front.

Assign the Deal

Once you prescreen your potential buyers and the right one emerges, you can assign the deal to your buyer or rehabber – assuming your contract is assignable.

When you do an assignment you’ll collect some cash now and the rest at closing.

We’ll look at what to do when an assignment is not an option in another post. This is where my “No Fee Transactional Funding” will come into play.

When we do an assignment, our buyer’s money is what funds the deal, and we sell differently than we buy. YOU always give the smallest earnest money deposit when you buy, but you want to collect the largest earnest money deposit possible when you sell.

Remember, whatever is due at closing, the title company will collect for you. Your buyer is essentially paying you to go away. And the best part? You don’t need the money to close and you don’t even need to be present at the closing!

And this is great because, as you know, your time is much better spent working on getting the next deal done.

So find the deal, flip it quickly, forget it and move on to the next!

Automate the Process

I can’t stress this enough: To build a sustainable house flipping business, automation is crucial, so you can repeat the process quickly and easily and eventually if it appeals to you, scale into other markets.

One of the ways you can “automate” is by using bird dogs. Have them find vacant properties for you. They need to be your eyes on the ground to take property photos, find estimate the square footage, and categorize properties to determine how much work is needed.

Have your bird dogs use a map that you’ve divided into sections based on your search criteria. Power through each section, then start back at the beginning. Keep the rotation going throughout the year, and work through your list of interested buyers.

The cream will eventually rise to the top.

While you’re working through the cyclical process, send an email blast to your wholesale buyers list to get them excited about your “deeply discounted” properties.

Wet their whistles but don’t get greedy.

Automation is a whole lot easier if you have a tool to help you manage and scale your business. I created and continue to use iFlip Real Estate, and I truly believe it’s the most powerful automated solution for real estate investors available today. Click here to test-drive iFlip 100% risk free today!

Now it’s all about repeating the process so you can cash checks often, and do it all over again… and again, (as often as you want).

It’s up to you to make that call based on your time, resources, and available funds but… you won’t need much.

In a Nutshell

Here’s to hoping that I’ve opened your eyes to the beauty (and profits) to the endless possibilities that vacant houses offer.

If you follow the tips and advice that I’ve shared with you along the way in this (pretty awesome, if I do say so myself) mini-series, you WILL be able to turn abandoned property (which are everywhere around you) into BIG paychecks–quickly and easily.

And those two powerful words, in short, sum up the theme of this mini-series– quickly & easily.

So… tap into those vacant properties, work the system, and keep repeating the processes that you’ve learned in this series. Want to start from the beginning? Want to start from the beginning? Click here to go back to part 1 now!

Start investing in your financial future today by investing in vacant homes.

What are you waiting for?

If you have any questions or comments about vacant properties, or anything that we have discussed throughout this mini-series, please feel free to leave any questions or comments below. I personally monitor and respond to them.

Best Regards,

Cameron Dunlap

I’m interested in sending a sampler targeted direct mail campaign to the local Lane County, Oregon vacant house owners. Wonder what this will cost me to do?

Thanks,

Joe Sandgathe

You’re looking at a range from +/- $0.85 to $2.00 per piece depending quantity and whether you’re sending a post card, letter or yellow letter.

Cam

Where does the money come from thats going to allow me to purchase these rundown homes in order to sell m fast

When you’re using the assignment of contract, you don’t need the money to purchase the house. You simply “sell” the contract and your right to buy. Then your assignee purchases the house from the seller directly. You find the deal, and get paid to go away.

Where do i start?

If one is only wholesaling, then won’t everything technically be “an assignment of contract”? If so, where does the transactional/free funding come in? (Is that if you have the A-B contract, and don’t yet have a buyer, or…?)

Good question Rachel. The funding comes in when you can’t, or choose not to do an assignment. Examples of when you can’t are when the house is bank-owned, is a short sale, is listed with a Realtor, or if you’re in Illinois and are not a Realtor yourself. In those cases, an assignment is out. Assignments are less popular and under more scrutiny than ever too.

Examples of when you might choose not to do an assignment include when you don’t want your buyer to know how much you’re making, or when you’re getting push back from the closing agent because they don’t like assignments.

I suggest you read my blog post on this exact subject here https://camerondirect.com/wholesaling-real-estate/

Hi Cam

Do I need a separate LLC in each state in which I want to virtually wholesale? Or do I just need a registered agent in those states, using my existing LLC? Thank you.

Kevin

Registering in other states will do the trick. Please seek the advice of an accountant.