Are you familiar with delinquent property taxes?

Long story short…a house becomes tax-delinquent when a homeowner falls behind on making property tax payments. When the taxes continue to go unpaid for a certain amount of time (which can vary by state and county) the property can then be sold.

I, myself, have bought quite a few properties as a result of delinquent property taxes. Most of them were directly from the seller rather than waiting for the auction.

How have I done this? Well…by simply accessing the list of tax-delinquent properties.

This list of properties contains those that will eventually be auctioned off at a tax sale in the county from where the list was pulled. You’ll see the properties that are on the docket, and when and where they will be auctioned off.

This information is not difficult to access. Every property owner in the United States is required to pay annual property taxes for the real estate they own. Taxes are paid to the city, school system or the county where the property is located.

This taxation means that detailed records are kept by the local tax assessor on every property within its jurisdiction. These records include:

- Who owns the property

- When they purchased the property

- How much they paid for the property

- How much each owner owes in taxes

- And so on…

This information is in the public records; that means the data is available to you on any property in the United States. Last sale amount is not disclosed in “non-disclosure” states, but that really doesn’t affect us too much in this scenario.

The List

After a certain amount of time of delinquency, the address and owner’s name goes on the list of those who are tax delinquent. This list goes by several different names, but they all mean essentially the same thing. Some examples are:

- Delinquent Tax Roll

- Tax Delinquent List

- Tax Forfeiture List

- Tax Assessor’s Roll

The time limit to pay the taxes and back taxes varies by county and state…ranging anywhere from 1 to 5 years. When that time is up, the county will “take” these properties from the respective owners by way of a tax foreclosure sale.

No matter how much they’ve paid on that mortgage…no matter how long they’ve owned the home…if there are delinquent property taxes, the property is eventually sold and the proceeds go to the local jurisdiction.

According to the rules, the property owner can redeem that property (have it removed from the list), by bringing the taxes up to date prior to the sale. There is usually a “drop dead” date meaning after which, the property is sold either way, but I’ve seen situations where the assessor accepts payment after the drop dead date and removes it from the docket. I’ve even seen a homeowner come running down the isle of the auditorium during the sale to make payment and it was accepted!

I guess we’re all human and the idea of losing one’s home for what might be a relatively small amount of money, garners empathy, which is what I would want it if it were me running down the isle.

Anyway, I digress…

I’ve found that a lot of properties get removed from the docket before the sale.

In some cases, the lenders do it. Why? Because the lenders know they’ll get wiped out if they fail to take action. A property tax auction WILL wipe out an existing mortgage regardless of size/value. So it’s possible that $10k in unpaid taxes could wipe out a $200k mortgage.

The Decided Advantage

So, I’m not entirely knocking buying at the auction. I’ve done it, but that’s for another discussion. What I prefer to do is beat those bidders at their own game.

My strategy is this: I find the owner before the property goes to auction, make a deal (when it makes sense) and close it before the sale so it’s removed from the docket.

Where I’ve had GREAT success is by looking at those addresses, then finding out who owns the property. If the house is vacant…and if the address of the house and the address the tax assessor shows for the owner are the same, I use a skip trace.

One of my favorite services to use to find sellers is RealEstateSkipTrace.com. It’s been a vital part of my success when I need to locate hard to find sellers.

Here’s how it works…

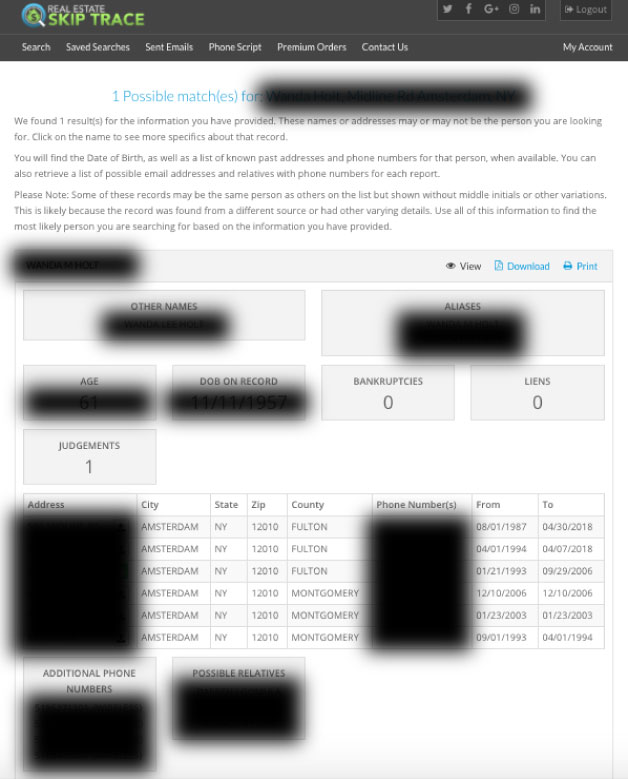

Note: Much of the info has been redacted to protect the privacy of the seller in the example, but when you’re using the system you get access to everything.

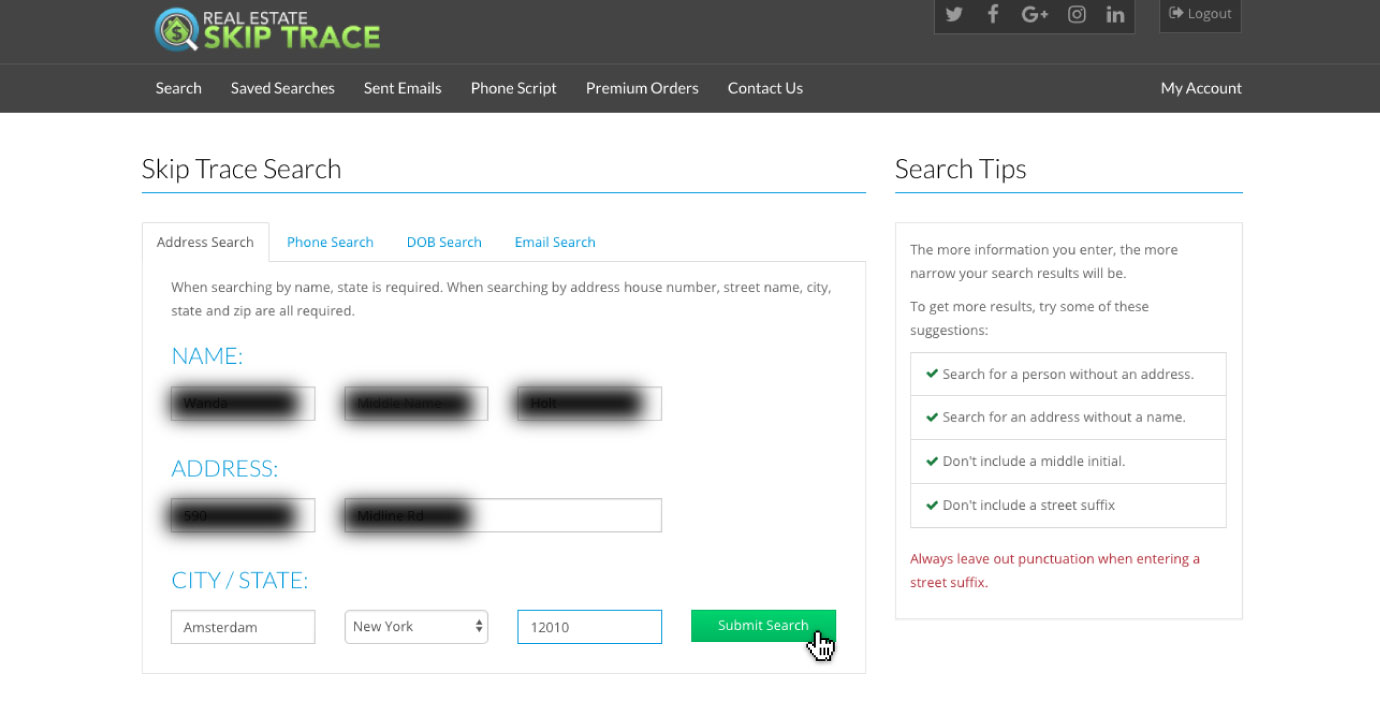

Step 1: Go to www.RealEstateSkipTrace.com and setup an account.

Step 2: Enter the Sellers address into the system like this:

Step 3: Review your results and start finding that seller within seconds – when others cannot!

…That’s it!

Once you’re able to locate the owner, the next step is to contact them.

Since the property has not yet been sold by the county, this information has never been released to the public. This means you have a decided advantage.

I’ve found that many of these homeowners are willing to sell at a deep discount…but they certainly aren’t advertising that fact.

This is definitely a motivated seller, though. They need someone to come in and offer help before the property actually goes to auction.

That could be you!

So…What Happens to the Overage?

My basic approach when communicating with the owner is to reiterate the fact that the house is on the list ready to be auctioned…then I offer to buy the house. I even go on to explain what actually happens at a tax-delinquency auction.

When it sells, the amount over and above the amount of the owed taxes will go to pay court expenses first, but if there is still more money, the county will rarely ever put, or even attempt to put it in the hands of that property owner. In most cases, they don’t even attempt to contact the now previous owner of the property and just keep the money…

I know what you’re thinking, and I totally agree, it stinks for the property owner.

Let’s say they own the house free and clear, and they owe $5k in taxes (which might be a mountain of money to them). They can’t even fathom scraping together that much money; especially having to get it together before the auction date. And yet, they own this house free and clear.

Perhaps it goes to the auction and sells for $60k. The taxes have been taken care of, and there’s this huge overage that the owner has no idea that he/she can go after. They don’t even know they’re entitled to it.

And sometimes you don’t even have to pay the entire tax amount. I’ve found that many local municipalities are willing to work with a payment plan and will still remove that property from the tax-sale status. This means that in some cases you can control the entire property with only a small percentage paid on the tax-delinquent balance.

Negotiating with the Owner

Here’s how I’d approach a situation like this…

In a case like this, that property owner would be thrilled to sell the house to an investor for $30k. That means they would walk away with $25k after the taxes are paid because there is “found” money that they wouldn’t have seen even a nickel of had it been sold at auction!

But, YOU were kind enough to contact them ahead of time and solve their problem. That’s how I’ve bought a bunch of tax-delinquent properties in my investing career and I see it as a real win-win.

Again, the trick is to buy from the owners before it goes to auction. There’s absolutely no competition, whereas, had I gone to the auction, I would have been head-to-head with a whole auditorium of potential bidders. I might have had to pay closer to $60k.

Of course, it would have been worth it. But if I could buy it for $30k, I’m much better off. (AND I would really be helping the homeowner – remember that.)

Essentially, by thinking outside the box and using the skip trace when needed, I’ve grabbed the deal right out from under the noses of all those bidders (the competition) at the auction.

Your Input

If you’ve had dealings with county records—specifically with delinquent property taxes—tell me about it in the comment box below. Your experience could help others too!

Regards,

Cameron Dunlap

Sounds like a good idea to pick up a house reasonable. Would the House then belong to you. If that’s the cast I would be interested in this.

County records almost always have to be taken in to consideration when turning these properties.

I’m excited about helping homeowners out by saving their credit through identifying the tax lien problem, locating them by Real Estate Wealth Network’s Skip Trace Program, and dazzling them with my new website that Brittany helped me set up at the Denver Summit! What a great time that was at the Summit meeting your great staff!

Thanks for your nice comments Joe. It was nice to meet you!

Can you please help me to buy tax lien properties

God Bless,

Had some of your stuff in the 90’s. Now have Vacant House Data feed and Skip Trace programs. Just bought a delinquent tax property from owner down the street from where I live with $125,000 in equity according to current market value. Now looking at another one using Skip Trace. Have not found owner yet though. Got any secret personal tips you have used to locate a hard to find owner?

The secret personal tip is… Skip Trace Four our new and improved basic search go to http://www.RealEstateSkipTrace.com or our premium search is at http://www.FindTheSeller.com.

This is great, I have bought tax liens before but only to benefit from the high interest rate that your money earns. I have never thought about buying property this way and its exciting. you are helping the property owner earn some money off a property they gonna loose anyway and at the same time you are buying this property cheap.

Thanks Cam.

This is a great read! What scripts do you use? How do you overcome objections?

I really enjoy this article. My head is spinning with ideas. Great strategy to use to find motivated sellers. I will use this strategy to find my next deal.

Thank you

Cameron