Virtual real estate investing is a more in-demand strategy than ever and, as I’m sure you know, the concept of “virtual wholesaling” has gained quite a bit of popularity over the last couple of years.

Now, virtual real estate investing is not a new concept. In fact, my systems and trainings have been highly focused on virtual wholesaling for years and I have the experience and proof to back it up. (Click here to see just a few of the folks who have closed deals through virtual wholesaling)

With that being said, I’d like to share with you a totally free, tried-and-true system that WORKS so you can successfully start virtual wholesaling in 2023 and beyond.

In this special article, I am going to reveal a streamlined process that I use to find motivated sellers. This is ‘inside information’ I have spent decades honing. It is the kind of information I ordinarily charge big bucks for.

Because my passion is to help people succeed, it is yours for free, with no strings attached.

It’s a detailed 20-minute read. Pour yourself a cup of coffee or print this out. It’s a complete blueprint you can follow step-by-step.

You are going to learn how to find bargain deals, how to find a buyer to sell your contract to, and how to put it all together…in 7 easy-to-understand steps…all virtually (if you choose).

Step 1: Find Motivated Sellers Now

The key to earning an honest profit in real estate is finding sellers that are going through a circumstance in life that requires them to sell now…aka ultra-motivated sellers.

Until very recently, these sellers were not quite as easy to find and you would have had to do a lot of digging, but I have discovered the easiest, fastest ways to locate motivated sellers in any market.

But first, let’s talk about finding your target market (AKA your “farm”).

Market Research

It all starts with picking the right spots to do deals. If you are too generic in your marketing approach, you’ll spend too much money hunting for deals and talk to too many of the wrong people. I see many real estate investors fail for this reason.

Here’s a great way to find the right area to start investing in…

- Head over to Zillow.com

- Type in a zip code near your home…

- Click “Search”

- Check “Recently Sold,” and uncheck the other “Listing Types”

These are the houses that have recently sold in your area so that you can see where the action is REALLY happening.

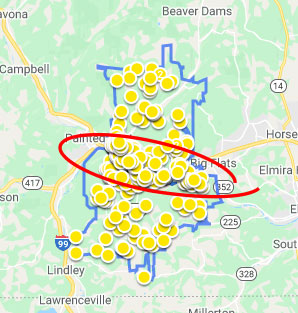

Look for the spot in your area where there are a lot of homes selling. This is usually the “starter home” neighborhood but could include “move-up” homes as well.

Zoom in a little, and look for houses that first-time home buyers would most likely buy…

This is your pot of gold. This is where buyers are buying all year long, every year of the century.

And because of this, your cash buyer (the person you’ll wholesale your deals to) is hoping for a deal like this to come across their desk.

Create Maps

Now that you know where your farm is, you need to spend a little time creating maps so that your driving time is efficient.

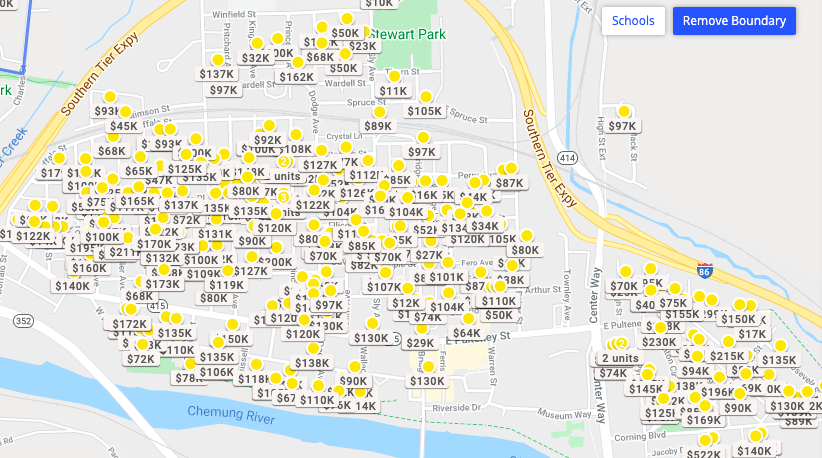

- Go to google.com/maps and type in the name of your area.

- Find your “farm.”

- Compare your Google Map to your Zillow Map and keep track of the boundaries of the area you are interested in.

- Zoom in on your google map so that you can read the names of the streets.

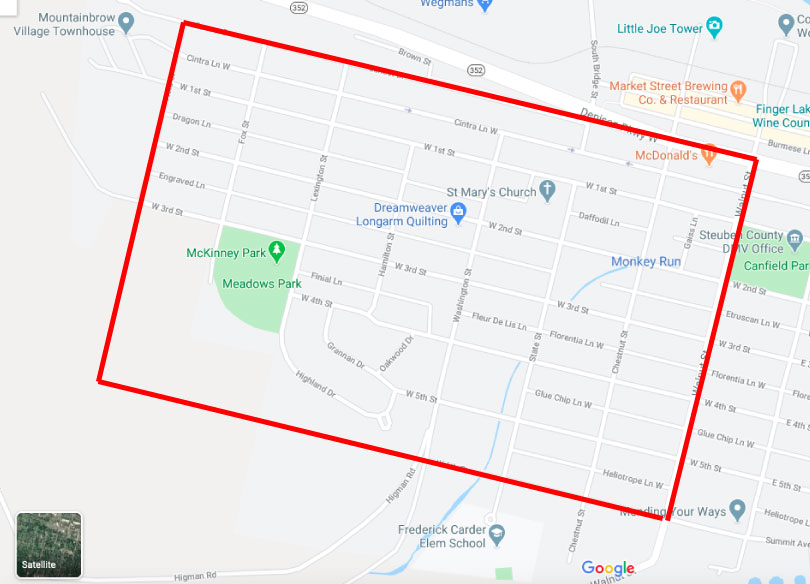

- Starting in your north-west boundary, create a map approximately ¾ the size of your monitor by taking a screenshot. If you have a Microsoft computer, it’s called the “Snipping Tool.” If you have a Mac, it’s called “Snippy.”

- Now print your map out, and repeat this process until your whole farm is printed out. If you are committing a whole day to this, you’ll usually end up with about 10 of these sheets before you go out. At the end of the day, you’ll usually end up with about 20-30 high quality leads.

Finding the Best Real Estate Leads

There are 2 ways to go about finding motivated seller leads. The first is…

Method 1: “Driving For Dollars” (Look For Deals)

NOTE: This method is optional because it DOES require you to leave the safety of your home or “quarantine”. However, since most of your competition typically avoids this method these days and because you can still easily practice “social distancing” with it, I decided this was still an effective option to add into this post.

For those of you who would rather stick to “working from home”, skip to Method 2!

So, now that you know where your farm is and you have all your maps printed out…it’s time to go find vacant houses, in bad condition.

The red border shows you the mini-map I would use to get started. I would start in the north and drive every street that goes north and south until I was finished. Then, I would drive every west to east street until I was finished. Then I would pull out the next mini-map and repeat, until I finished driving my whole farm.

I like to put these sheets on a clipboard and draw a line in each street as I go so that I am not back-tracking.

As you drive, look for houses that are in bad condition…this is the first sign that would cause you to slow down.

Tip: The worse the condition, the higher the probability that the seller is motivated. Here are the types of things I am looking for…

- A roof in bad condition

- Stickers on the front door

- Grass is super tall

- Landscaping is neglected

- Boarded-up or broken windows

- Mold all over the siding

- No curtains…no furniture in the house

- Pile of newspapers

- Mail falling out of the box

- No tracks in the snow in the driveway (northern markets)

These are all indicators, not requirements. The overall goal is to find vacant junker houses.

If the house is vacant, that is a good indicator that the seller is motivated. If the house is also in bad condition, that is a great indicator that the seller is motivated. Ideally, you want both, but you need to use your best judgment while out in the field.

If you don’t have a car, your market is across the country or you prefer to work strictly from your desk, here is another way to find deals…

Method 2: Automated Deal Finding

The second way you can find motivated sellers is by using an online resource like the Motivated Seller Data Feed. This software lets you search the entire country, zero in on your specific farm area and then provides you with all the motivated sellers (with up to 20 motivations) in that area.

Using a software solution like this gives you unbelievable speed of implementation and can really help you keep a steady flow of leads going through your business.

With the Motivated Seller Data Feed you’ll get access to:

- Verified Vacant Houses

- Chapter 7 and Chapter 13 Bankruptcies

- Foreclosures

- Absentee Owners (In town, out of town, out of state!)

- Liens

- Judgments

- Inherited houses

- Upcoming auctions

- Built in Mail Manager & Marketing Templates

- NCOA addresses and phone numbers (when available)

- The ability to order skip trace searches with a few clicks of a button

- Seller phone scripts

- And more!

If you prefer to “work from home” and find great leads, then this is an avenue you’ll definitely want to check out. You can get full details on the Motivated Seller Data Feed here.

Step 2: Pre-Screening the Deal

So now, if you went with Method 1, you are in front of a house that appears to be vacant and in disrepair. Get out of your car and peek through the window to confirm it is vacant. Then, go around the whole house and look for windows without curtains, to see what the condition is like inside.

Square Footage

You’ll need to confirm the house is vacant and get a good idea of what the interior condition is like. Use your judgment. If it seems like a good opportunity, it’s time to determine how many square feet the house is.

You need to measure your stride in advance. Take a tape measure and walk the length of it, taking a normal stride. Now divide the number of feet of the tape measure by the number of strides and that is your average “feet per stride”. Once you know this number, you can use this average for estimating the square footage of all of your properties.

Using the same normal stride, walk the length, and record the number of strides. Now multiply that number by your average feet per stride. Now repeat for the width of the house and multiply the length by the width. If there is a 2nd story, double it. If there is an addition, add it. This gives you the approximate square footage of the house so that you can do a better job of evaluating the “after-repair value” of the house.

If the house is less than 850 sq ft, I tend to shy away. Our “bread and butter” properties are houses that an average sized family would move into. If the average house in your area is small, then go for it. The key is to make sure that the house will be in high demand after it’s fixed up.

Salability

I also look at the style of the house. Perhaps in your area, ranches are in high demand, but 2 stories, not as much. If the seller is motivated and I think I can make money, I will do the deal knowing that the demand is lower, but that means the offer has to be lower.

The typical family wants a 3 bedroom, 2 bath house with a cute yard and would love a garage and basement. They don’t want funky houses, but since this is their first home, they are not too picky. Just realize that the closer you get to the ideal house… the higher the demand and the easier it will be to sell.

How to Estimate Repair Costs

While you are at the house, you need to make an estimate of repairs. The best way to do this is…quickly!

You do not know if the seller is motivated yet, so you do not want to waste your time estimating repair costs on a hundred houses. You’ll already have a good idea of what needs to be done on the inside, now factor in the outside.

If the house is in move-in condition or better…it’s probably not going to a very good lead. You can add it to your mailing list if you want because the seller might be motivated… but if it is a “pretty house,” it will be a different exit strategy than what we are discussing now.

For houses in bad condition, I do not go line by line and figure out each repair cost…I simply classify it as bad, really bad, or awful:

Bad

- Needs a new kitchen, bath(s), paint, flooring, fixtures, minor plumbing, minor electrical, minor landscaping

Really bad

- Everything listed in the bad category, plus electrical panel, HVAC, roof, major wall repairs, more landscaping

Awful

- Everything listed above plus new windows, siding, foundation issues, structural issues, major wood rot, re-wire, re-plumb, major landscaping

If the house is in “bad” condition, I estimate that the cost to repair the house will be $20 per square foot. I take my square foot measurement from above and multiply it by $20 to come up with my estimate of repairs. That’s it!

The truth is, everyone has their own ways of fixing things. A bank may pay $20/foot to get the same work done that a “do-it-yourselfer” would pay $5/foot. I do the math in my own rehabbing business, and I tend to pay about $20/foot to have someone fix up a house for me when the property was in “bad” condition.

When the house is in “really bad” condition, I use $30 for my multiplier.

When the house is in “awful” condition, I use $40 for my multiplier.

It is important to note that this is what I believe that I can get it done for. The person you wholesale it to may have a different opinion. What I really care about is making the right offer and selling the house to the right buyer.

The real beauty of my repair formula is its simplicity and flexibility. It doesn’t get a whole lot simpler, and then if you need to, you can adjust the price per square foot to fit your market. Plus, when you’re ready, it allows you to estimate repairs on houses you’ve never seen or visited in person (like the ones you find on Motivated Seller Data Feed). For many of my students, this formula is a big part of what makes it possible for them to do deals in other cities, in some cases halfway across the country, again, without having to visit the house.

The best buyers in your market buy houses like this on a regular basis, and they have a crew of workers who fix up houses for them. These are the types of buyers I am looking for after I contract the house, and I want to use the repair pricing they would use.

Tip: This exercise should take no more than 5 minutes per house.

If the house is a “tear-down,” pass on it. You can make money on these deals, but you’ll need a different kind of buyer that is harder to find.

Now that you have your repair estimate, add it to the back of the mini-map along with the address of the property.

Since you are flipping houses with no money, I recommend doing this until you find 50 – 100 vacant junkers. It’s a numbers game, so if you have a large number of sellers to talk to, and considering that owners of vacant houses are categorically motivated, there is a good chance that you will find a motivated seller and put a deal together in short order.

Remember, your goal is to get a deal done within 30 days from today. You need to remind yourself of that every day, and focus ONLY on the activities that generate revenue.

Step 3: Find The Property Owner

At this point, you should have a pile of hot leads. These are houses in bad condition that are vacant. Knowing this…you can be confident that the seller is motivated. You do not know this yet, but you have a much, much higher chance than putting an ad in the paper, etc.

Since the house is vacant, you know they do not live there. Now you have to do a property owners search so that you can let them know you are interested.

How do you find the owner?

You have to get access to county public records. Most counties have this information available online for free. You can Google “____ county property tax records”. If you cannot access this data, you may have to go into the county courthouse and visit the “tax assessor” and ask how you can find owner information. Don’t worry…they get this all the time, and the information is publicly available.

But, I have a shortcut for you…

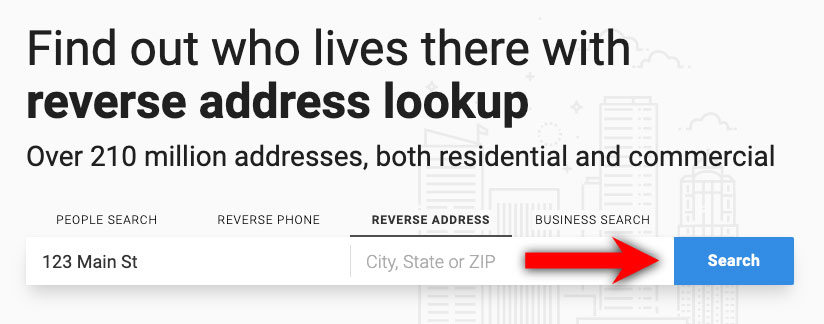

- Go to www.whitepages.com/reverse-address

- Type in the address in the main search bar

- Hit “search”

- From here, you can see Owner and current residents, property details, neighbors and more

Now you have the public records on the vacant junker you just found.

You will have to do a little digging at this point. What you are looking for is the most recent “tax bill”. This tells you where the county sends the property tax bill and who is responsible for it.

That is most likely the owner of the house. Now record the property owner by address and track them down.

At this point, you can do a Google search with the name and address of the person. Sometimes, this will give you all the information you need. However, sometimes you’ll have to do quite a bit of digging. Look in several places, and try your best to find their most recent address.

It is quite common to see matching addresses. This is where the address of the vacant junker is the same as the mailing address with the county. Most investors consider this a dead end…. But not me!!! And not you!!!

This is where you set yourself apart from the competition. This is one of the biggest reasons we can be flipping houses with no money.

Common sense says that if we send a mailer to the owner at the vacant house, it is a waste of money. But when you understand how the United State Postal Service works, what it really represents is…opportunity!

The owner will often leave the house and set up “forwarding” with the USPS. This means that all mail sent to the vacant house will get forwarded to them at their new address.

It also means that you can learn the new address. (The Motivated Seller Data Feed Software I talked about earlier provides ALL of this information at the click of a button as well. A huge time saver.)

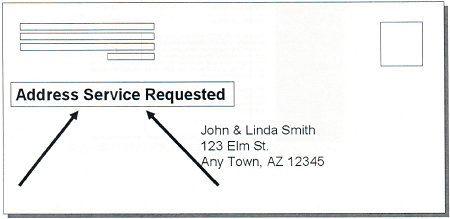

You have to put a little language on your letter to let the USPS know you are interested.

By placing the term “Address Service Requested” underneath your return address, you compel the USPS to photocopy your envelope, forward your letter, and then send you the photocopy with the new address. There is a fee for this service and can only be used when you use first-class mail. It’s generally around 75 cents per return.

Here is an example of how it should look…

You can print out stickers on your computer, you can hand-write it, you can get a stamper, it doesn’t matter… just include that language when the seller’s mailing address matches the vacant junker house address.

If the seller’s mailing address is different than the house you are interested in, then send the letter without “address service requested.” The more personal and friendly it looks, the more likely the recipient will open it.

If you did not find the owner in Google, your other options are…

- Phone book

- Knock on the neighbors’ doors

- Put an FSBO sign in the yard of the vacant junker with your number on it

- This will get you calls from neighbors and the angry owner

- Not a great first impression, and riskier… but desperate times call for desperate measures

- Skip trace search

- I actually do so many skip traces in my real estate business that a number of years ago I created the best of the best skip tracing tools available for real estate investors. It’s called FindTheSeller.com

- This will get you calls from neighbors and the angry owner

Using a service like FindTheSeller allows you to skip most of the steps in step 3, saving you a TON of time and effort. If you have access to the Motivated Seller Data Feed, you can run skip traces in a snap right within the system.

Step 4: Pre-Screen the Seller

Once you get the seller on the phone, you have to determine if they are a motivated seller or not. You don’t want to waste time driving all around town…meeting with sellers who would never sell to you for a discount.

What To Say To The Seller

Whether you are calling or sending a letter, the message you want to get across is that you have a solution to their problem.

Let them know that you will buy the house “as-is,” you will make a cash offer and you can close on the date of their choice.

Don’t worry about the money part…I will address that later in this article. They don’t have to know that you are flipping houses with no money.

Make sure to ask them the magic question…“If I paid all cash and closed on the date of your choice, what would be the least you could accept?”

Now, wait for their response!

You may be uncomfortable with this question, but this is the turning point. If their response is favorable, you have a deal. If their price seems too high…you are most likely talking to an un-motivated seller.

Your job is not to convince anyone of anything. These are people that are desperate for a solution to their problem.

Your job is to find out how you can help them. The right kind of seller is not as motivated by the money as they are by “peace of mind.” They are paying double bills while the house continues to degrade. They don’t know what to do, so when you call them offering to take it off their hands, they tend to be excited and grateful.

You promised to make them an offer… now it’s time to deliver.

Step 5: Estimate House Value

This is the most critical component of the whole process.

If you get this right, your buyers will love you, your offers are based on reality, and the rest of your career will go much smoother because you will understand values in your farm off the top of your head.

Your goal is to determine the “After-Repair Value” (also known as the “ARV”).

This is the value the house WILL be in after it has been fully rehabbed. This is the price that the end 1st-time home buyer is willing to pay.

You need to find out how much your house is worth yourself because if you hire an appraiser on every deal, you will go broke, and you need a little more control of the process. If the appraisal takes a week to come back, you will have most likely lost the deal to another investor by then.

Using comparables (also referred to as “comps”) will help you determine the ARV. It is critical that you use the correct comps, though.

There are 3 main components to selecting the right comps…

- Proximity

This is how close the comparable house is to the vacant junker you are interested in. In a perfect world, the comp would be on the same street, but if it is in the same subdivision, that is still a good comp. If you can’t find any, then just make sure to keep it under 1 mile away from the vacant junker. If you live in a rural area, you may have to expand and include anything that is in the same town and school district.

- Recency

This is how recently the comp sold. Did it sell last week? Last year? The more recent it sold, the better. Ideally, you want comps within 30 days. That is not always possible, so if you need to expand out to 90 days, that would be good too. Worst case, don’t go out any further than 1 year.

- Size & Amenities

Make sure the number of bedrooms is the same. The number of bathrooms should also be the same, but if it’s off by ½ bath, you can work with it. You want to make sure that the square footage is within 200 sq ft of the subject property. For example, if the vacant junker you are looking at is 1,200 sq ft, the comps have to be within 1,000-1,400 sq ft. You also want to look at the characteristics of the house…. Is the style the same? The age similar? Similar lot size? Same quality neighborhood and location? Does one have a pool and the other doesn’t?

You want to narrow this down to your top 1 or 2 comps. You want the best, most relevant comp… the one that is so closely alike that your buyer can sell your vacant junker for the same price after they are done rehabbing it.

If you have identified several and are not sure which 1 or 2 are the best, drive by them all… the “EYE TEST” usually answers the question immediately.

Where To Get Comps

If you have access to your local MLS, that is the best case scenario. If not, call a Realtor friend and ask them to help you pull comps. If you don’t know any Realtors, Google them. Use terms like “foreclosure,” “investor,” or “short sale” along with your area in Google so you can find Realtors who specialize in working with investors like you.

A few little secrets that most people don’t know…

- Some home inspectors have access to the MLS

- Some real estate investors have access to the MLS

- Most real estate attorneys have access to the MLS

- All appraisers have access to the MLS

- All title companies have access to the MLS

If you have any friends that do any of these jobs for a living, there you go!

But, I have another shortcut for you…

Available Now…

You may have heard of my deal automation software platform called iFlip Real Estate… it allows you to automate and scale your investing business in the fastest time possible.

Well, today I am pleased to announce that you’re now able to get your hands on the all NEW iFlip Real Estate, and this automated deal-management system is bigger and more powerful than ever!

The reality is, we’ve been working on this new update for quite some time and, while we’ve been itching to release it to the world, we simply refused to do so without making sure that everything was tested, proven and ready to help you start earning more money in your business.

This new update is going to blow you away if you like the idea of…

…more motivated seller leads!

…automated deal flow!

…unlimited customizable, SEO-powered, lead-generating websites!

…Intuitive and easy-to-use design!

If you’re ready to make 2023 your best year ever, then hurry here to access this system today.

What you want is THE best comp. You want to do whatever it takes to find out the true ARV.

Crunch The Numbers

Now you know which house is a good candidate, you know that the seller is motivated, you know how much it costs to repair, and you know how much the ARV is… so let’s figure out how much you are willing to pay. If you get this right, flipping houses with no money goes much smoother.

I use a real estate valuation formula that is used by the majority of rehabbers across the nation…

ARV x 70% – repairs = Maximum rehabber purchase price

But, that is how much my buyer is willing to pay…how much am I willing to pay?

My personal formula is ARV x 65% – repairs

That is the most I am willing to pay…unless my profit is less than $5,000…I make sure my top price always makes me at least 5k.

I always offer something lower than that though, in order to give the seller some room to negotiate and to improve my margin if I can.

You can access my FREE online Offer Generator software to help you speed up the process as well. Click here to access the Offer Generator.

Step 6: Making an Offer on a House

I want the offer to be low…very low! Shockingly low!

I literally want them to be shocked!

Why?

You know that feeling you get when someone told you some very bad news, and then later you find out the news was incorrect?

That was a relief, right?

You are not asking for an apology, as much as you are grateful that it was not true.

That is the same shock effect I want you to give the seller.

If you are willing to pay up to 100k, make it much lower… like 80k.

They are probably thinking the house is worth 150k, so when you come in with a lowball offer like 80k, they are thrown off-guard. This gives you an opportunity to open their minds to the reality that their house is not worth 150k and still leave room for a profit.

Have you ever seen those pawn store shows on TV?

It happens every time…

The seller walks in with an item expecting 150% of its value…the buyer offers something closer to 50% of its’ value…and they settle somewhere in the middle….somewhere closer to the 50% figure, so the dealer can make some money.

The seller expects you to negotiate…so negotiate.

Make an offer so low that when you get closer to your max purchase price after some negotiating, it looks like good news, and now you are a friend helping them.

If the seller named a price on the phone, and the number was lower than my formula, I usually tell them I am willing to pay a number that is a few thousand dollars less. I really don’t want to negotiate in this situation. I am not out to take advantage of people, but at the same time, I do not want the seller to get “sellers remorse.”

If they are asking 100k for it and I am willing to pay up to 110k… I will offer them about 97k. If they accept it, great! But I am expecting them to say, “no, 100k is as low as I can go.”

Then, I “think about it” for a little bit (so the seller does not suspect that I am doing this) and I say something like “I guess that will work.”

Try not to give away any “tells” about how excited you are.

This business requires us not to be greedy. You are trying to make 5,10,15k and move on to the next deal.

You will build a sustainable business if your offers aren’t so low that sellers feel you ripped them off but not so high that your buyer can’t make money flipping it and then as a result you can’t sell it.

Fill Out the Contract

Now that you know how much your real estate offer will be, it is time to fill out the contract.

Ideally, you want to use your own contract that is short and very easy to understand. If you can sit down with your seller and read your agreement word-for-word and they feel comfortable, you are likely to get the deal right then and there.

Try to walk away with a contract. If not, any number of things could happen that could cause you to lose the deal. Here are a few common scenarios….

- The seller shops your offer. They call other investors in your area to see if they are willing to pay more.

- The seller changes their mind and decides to hold onto it a little longer.

- Their lawyer/brother-in-law/teacher convinces them that they could get a higher price.

Here are some other options if you don’t currently have a contract to use…

- Ask a friend that is an investor if you can use their contract.

- Ask a Realtor to show you how to use the Board contract for your state.

- If you know who your attorney will be, ask them for theirs.

Make sure the contract is “assignable.” When you put your name in the buyer section, put “or assigns” in there immediately after it. This means that you OR the assignee (your buyer) is allowed to close. This is the technical piece that allows flipping houses with no money to happen. Your buyer has the cash, so you don’t need any.

Contract tip: Use $10 for your earnest money deposit. In order to make your contract enforceable, you have to provide “consideration.” If you put money down and the seller accepts it, that is “consideration.” I always like to put something down, but any more than $10 is not necessary. Sometimes I put $100 down, but really if the seller asks for something more, I know that I am working with the wrong seller. They shouldn’t care about earnest money, they should just care that you are providing them with a good chance of getting rid of their headache. Keep in mind we are talking about private sellers, like Harry and Mary Smith. Not bank sellers. Banks have different expectations and requirements that we’ll cover another time.

Step 7: Closing On a House

Now that you have a contract on the property, it’s time to get paid!

The next step is to turn your contract in to your Real Estate Attorney or Title Company. If you don’t have a lawyer or title company yet, here is how to find one…

Call the president of your local Real Estate Investors Association, and ask them for a referral.

If you don’t have a REIA in your area, then look for the closest one in your state, and ask that president.

The reason you are not looking in the yellow pages or on Google is because you need an “investor-friendly” Attorney or Title Company who understands wholesaling. It is very common for them to say that wholesaling doesn’t work (because 97% of deals are retail deals). They are not used to seeing wholesale transactions. Wholesale deals are usually off-market, not on the MLS, and not through a Realtor, which is how most closing agents are accustomed to doing business.

The fact that you have a contract in hand gives you a lot of credibility with the local REIA president, and there is a good chance that he/she is an investor and would be interested in being your buyer.

In addition, going to a Real Estate Attorney or Title Company with a contract in hand speaks volumes as well. Nobody likes their time being wasted, especially closing agents.

You have to:

- Come to them…

- With a deal in hand…

- AND represent a repeat customer if everything works out as planned.

They should be happy to talk to you about being your real estate transaction coordinator.

Once you hand your contract over, your lawyer will communicate with the title company who will pull up the property in their system and look for any liens.

Sometimes the seller means well, but forgets to tell you or does not know about a lien.

While the title company is working on that, your job is to…

How to Sell a House Fast

The first thing I do after turning the contract over to my closing agent is place an ad on Craigslist. You may be surprised at how many cash house buyers scour Craigslist every day looking for deals. I set the price at whatever looks attractive. I make sure that my price is lower than what it would be if it were in the MLS as a fixer-upper.

Then I create a flyer. I can use this to send in the mail to cash buyers or store it on my computer so that I can email it to anybody who requests it.

You can go to your MLS and look for cash buyers, but you only get access to the ones who bought through the MLS… and remember… most wholesale deals are not done through the MLS.

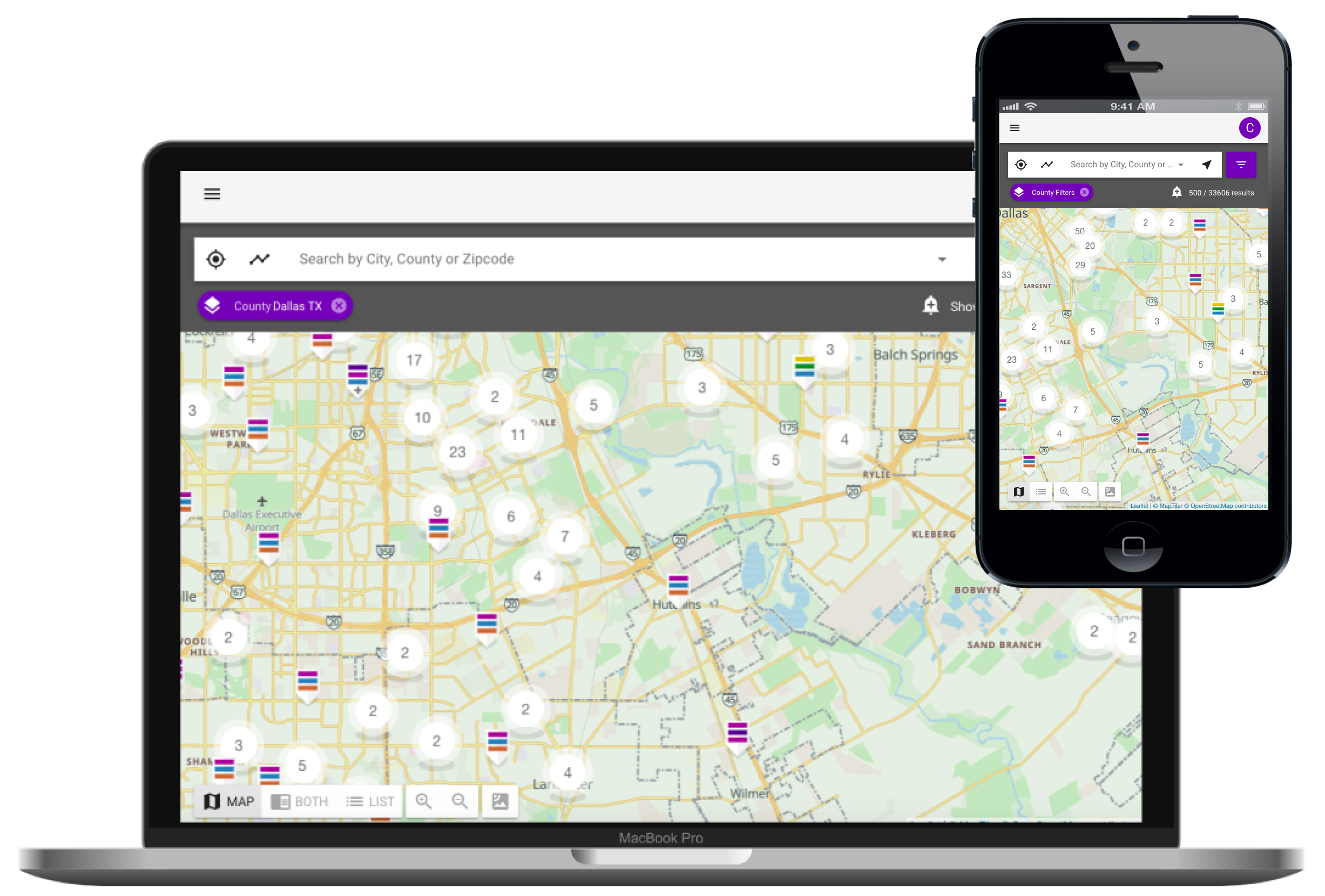

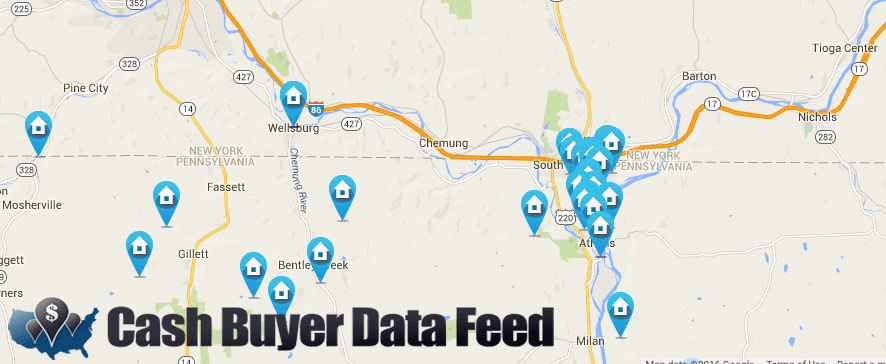

That is why I created the Cash Buyer Data Feed. I use this in my own business, and many of my most successful students are using it right now. It gives you access to all of the known investors who buy houses for cash across the country so that you can contact them and sell your deal in the fastest time possible.

You can simply enter a zip code, click search and see all the cash home buyers in a map like this:

This software even allows you to send mailings and provides you with phone numbers for the buyers when available.

If you’re not using the Cash Buyer Data Feed, you can go to Click2Mail.com and send out postcards to the cash buyers you find. Let them know about your deal and how to get in touch with you.

While the postcards are processing, go online and look for “I Buy Houses” type ads. These are investors looking to ‘”fix & flip,” ”buy & hold,” or they are your competitors. Call all of them and ask them if they are interested.

During this whole process, make sure to keep your eyes peeled for any ads that say something like “I Buy Houses.” You may see those yellow signs on the road, a billboard, an ad in the paper, flyers at the grocery store, Starbucks, etc.. You may have an investor association meeting coming up, you may have a “MeetUp” group coming up, you may see “for rent” signs while driving through neighborhoods… however you find them, make sure to keep a database with their contact information so you can call them when you have a deal.

Some other creative ways to find cash buyers for houses….

- Attend the foreclosure auction and meet cash buyers in person.

- Go to your courthouse and search recent cash sales. Record the buyer and their address so that you can send a mailing to them. This is the more painful, time-consuming version of what you can do in the Cash Buyer Data Feed.

- Go down to your local housing authority (AKA “Section 8 Office”) and ask for the landlord list. These are real estate investors. They may be looking for a new deal.

- Put a “for sale” sign in the yard of the property. Ask the seller for permission.

Get A Contract With The Buyer

It looks like you found the right cash house buyer, but now you need to hash out the terms of the deal.

It is very important that they can close fast. Anything more than 2 weeks is not acceptable to me. Real quick house buyers with a lot of experience can close in a day… but because the Attorney or Title Company has to do their thing… it rarely goes that quick.

It is also important to me that they put down a non-refundable deposit. I like to see at least $1,000, but if I am having a tough time selling it, I may go as low as $500. Usually, I start around $2,000 and see if I can get it. The more they have at stake, the more likely they will close.

They must show me proof that they can close with cash. I don’t care if it’s a hard money loan, a line of credit, or cash in the bank… whatever makes me feel confident that they actually have the money to close.

Once they sign the deal, they have to close. If not, you keep their earnest money.

But of course, they will need to see the house before they can agree to this, so you have to have a way to let them in. Since you have a contract, the seller cannot go around you, but you still want to control the showing process. Try to get a key from the seller. Let them know that you have to show it to prospective buyers, contractors, etc. and rather than waste their time driving out to show it a half-dozen times, you are willing to handle it yourself.

Then go to Home Depot, and get a lockbox. Put it in a spot that is not very obvious, and tell your buyer where to find it. Remember, this buyer must have shown you proof of funds.

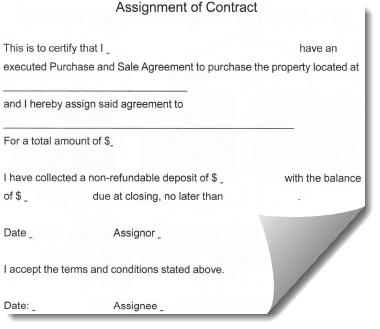

Once the cash buyer is satisfied with the house and the deal, it’s time to collect earnest money and assign your contract.

Here is an example of what the assignment agreement could say…

Nothing fancy…it just says that you agree to give them the rights to your contract.

You can re-create a doc like this in your favorite text editor.

Once this is signed, email it to your Real Estate attorney, and he/she will put it all together.

You just flipped a house without using any of your own money.

All that is left to do is cash your check. You do not even need to attend the closing for that.

When you assign your position, you are like a lien on the property. There is nothing more for you to sign. You have to get paid off before the title can transfer, but your name never goes on title.

Pretty cool, huh?

Virtual Real Estate Investing On Rinse And Repeat

Now, how would you like to flip a switch to automate this process from start to finish?

With iFlip Real Estate, you’ll get instant access to push-button streams of sellers, buyers and birddog leads, fully upgraded SEO-optimized website templates, an automated offer blaster to submit more offers and more. Go here to learn more and access this system today.

There You Have It

That’s my Complete Guide To Virtual Real Estate Investing…From Your Kitchen Table (With No Money, Credit or Experience). I just taught you everything you need to know to start making money in real estate virtually.

If you run into any problems… just remember… you are working with motivated sellers AND motivated cash buyers. They are usually grateful for your service and are unlikely to have a problem with you letting them know this is your first deal. It’s OK to get back to them later if you don’t know the answer to one of their questions during any of the steps outlined above.

If you have any questions for me… please leave a comment below. I answer them personally and truly appreciate your feedback.

Regards,

Cameron Dunlap

P.S. Looking for a hands-on training experience to become a successful virtual wholesaling investor in 2023? Then you need to join me for my upcoming Real Estate Wealth Summit where I’ll take you step-by-step through the process of finding and landing deals in any market across the U.S. LIVE! Click here to join me!

Currently devouring the vacant house bank investment program, is this something better or in addition to?

Thanks Cam for sending for sending me this excellent program. I will try to make something happen using this blue print.

Thanks,

Henry Foldberg

thank you very much for the info Cam it was VERY INFORMATIVE .

Mike Martin

Thank you very much! It IS very informative and helpful!

Vladimir Borovskikh

Cam, once a cash buyer is indentified, a down payment for a non-refundable deposit is made, a proof of funds is shown, the next step would have an assignment of contract signed before they see the seller property, is that correct. Showing me the proof of funds should I ask for a copy of it or that’s not necessary. Is it authomatically understood by the title company that my name is not placed on the transfer.

Get a copy the POF, A contract with the seller is enough to show the house to buyers because you “control” it with that. Assignments under scrutiny and can only be done with private sellers, so be thinking about a back to back closing too.

I feel comfortable with all aspects of flipping a house except for finding a cash buyer before my scheduled closing date with the seller.

If you’ve got the house cheap enough, finding a buyer will not be a challenge. Cash buyers pounce on good deals. Our Cash Buyer Data Feed is an inexpensive insurance policy providing you with known cash buyers. Then all you need is 1 or 2 regular buyers and you’re set.

What happens if you make a contract with a seller, but can’t find a buyer?

A couple things. First is for you to realize that you were willing to pay too much for the property, which is clearly evidenced by the lack of interest from buyers. If your asking price, which has your profit margin built into it, draws little or no interest, this should be abundantly clear to you and should serve as a lesson to carry forward to your next deal.

As to the contract with the seller, if you have an inspection period, and you’re within it, the house would be found to be unsatisfactory and you would demand your Ernest money back. If you don’t have that out, you might lose your earnest money deposit. The “trick” is to buy so low that your buyers simply can not refuse.

Cam, do you know if Assignment of Contract is legal in Texas? Can you explain in more detail how a double closing would work if had to go that route please sir?

Assignments are fine in TX but scrutinized and becoming less popular everywhere.

A detailed explanation of a double close is not practical here. Please attend one of my events.

Thanks Cam very informative info

Cameron Dunlap one of the most unselfish incredible person of the century! Thank u for all u do Cameron you and your program are absolutely Incredible!

Very imformative, thank you!!

Cameron Dunlap you are extremely generous with all steps we need to complete a buy and a sale. I’ve been away from the industry for quite some time and was interested in what was possible in 2021.

You are very clear and concise and I appreciate all the work you put into writing these posts. They are extremely clear and helpful. Thank you!!!

I am buying into the program after attending the last three day wealth summit. I have always wanted to do this, and now after the last three days, I feel that working with Cam and his team is going to make it possible for me to tackle this business! I have confidence that I have the processes needed at my fingertips that will enable me to complete these transactions! With the knowledge and experience that Cam and his team are sharing with me to support my efforts, I am very excited to get started and move forward to become financially independent!

Hi Cam,

At what point do we find out what’s owed on the property? What’s the seller’s initial mortgage amount and what is still due? Wouldn’t this be beneficial when doing our due diligence on comps, ARV, and MPP?

All The Best…

There is debt stack info in our Motivated Seller Data Feed, but the good old fashioned way is to ask the seller. If they push back on your asking, they’re probably not motivated.

Cam

This is an excellent outline and review of the wholesale process, and how to benefit by having the right tools. Thank You Cameron

Great advice Cam on asking the seller the good old fashion way. I like that! Thanks Cam.

Thank you for sharing this information CAM. I am happy to have attended the 3-day Summit. I leaned so much that now I feel so comfortable in getting started, and I’m ready for success!! Hope to be sharing good news soon!

I’m new to wholesaling and was wondering how hard this would be to start. I’m young and value hard work so, I would like to get a head start on my career. Would being young also make it hard to start?

Young and willing to do the work?….

You are perfect for this and the time is now!

Cam

New for PA in 2025. Sounds like dual closing will be best in PA?

Here’s the article for folks in PA.

https://www.barley.com/act-52-imposes-new-regulations-on-real-estate-wholesaling-in-pennsylvania/