Investor friends, here’s a short yet interesting post that I think you’ll appreciate. It, of course has great lessons to take away…

It dawned on me that you could benefit from hearing this story about how I got past a few bumps in the road when wholesaling REO Properties with an FHA-approved REO.

You see… this could have turned into a complete disaster – with loads of time and effort lost and wasted. But thanks to some preparation and creative thinking, I managed to make it work.

I want to share this lesson with you, so you too, can see that we all will definitely encounter challenges, hiccups and even major obstacles along the way in our investing careers – but rather than get discouraged – we work through them… and we’re better for them on the other end.

The importance of a strong buyer’s list

Realtor friend and colleague of mine – an REO listing agent that I had worked with many times – told me about a bank-owned REO property before it went on the market. He wanted to know if I’d be interested in the deal before it was listed.

This was what I call a “pre-list REO”…

REO: You probably know that REO stands for “Real Estate Owned.” If a foreclosure property is not bought at auction, it then reverts back to the lender and becomes an REO. REOs are owned by banks.

Okay so…this pre-list REO property needed only plumbing repairs – the pipes had frozen, which is actually pretty common in my area. We’re talking minimal work, time and money to get the property up to par.

So far so good.

They were asking $72,000, and long story short – I got the deal for $60,000.

Using my buyer’s list, I quickly found an end-buyer investor who agreed to buy it for $75,000. Not bad! That would have been a nice $15k payday for me.

But…

For some reason, which I’m still not clear on, that investor backed out. But, I did get to keep the $2k earnest money deposit, so that certainly helped. However, that left me with a new problem.

Now I had to find another end-buyer – and fast. But, I wasn’t too alarmed…

See, when I initially reached out to my buyer’s list, I actually had 2 or 3 other investors who were also interested in the REO property. So I went back to those investors – and one of them had previously said he’d give me $80k for the deal.

So, I sold it to this back-up buyer for $80,000.

The lesson here – don’t panic, be prepared with a solid buyer’s list.

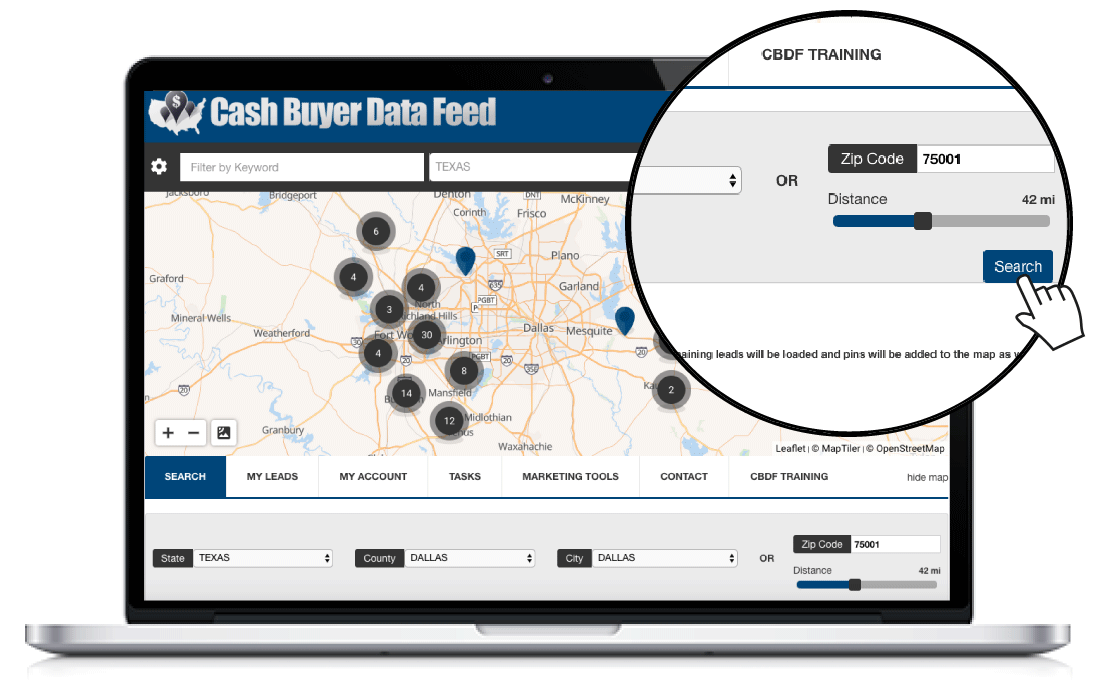

I use the Cash Buyer Data Feed to ensure I have a solid buyer’s list. This system gives you access to real, verified and active cash buyers in any market and gives you the confidence to go out and start making offers immediately!

Flipping a property without the FHA flipping out

Now, while very unusual for investors, it turned out that the end-buyer was working with an FHA loan. (Just in case math isn’t your forte, that’s a $20,000 spread: I bought the deal for $60k and sold it for $80k.) We planned to close fast, within a few days.

FHA: Again, you likely know that the FHA is the Federal Housing Administration. It sets standards for construction, underwriting, and insures loans made by banks. It provides mortgage insurance on loans made by FHA-approved lenders throughout the United States.

After I bought the REO property and fixed the plumbing, the house was then appraised for around $100k.

Now, here’s where this deal gets even more interesting…

The FHA actually wanted to know what had been done to the property to make it worth $80,000 – remember, I bought it for just $60k, which was a $20k difference from what I was selling it for. As I mentioned, we repaired the plumbing – that was pretty much it.

So, I presented the FHA with the list of expenses. At first there was a little concern, but eventually it worked out based on the numbers, and the FHA gave their stamp of approval and agreed to proceed with the loan.

I’ll explain why in a second, but…

This could have turned south again, quickly

After looking at all the numbers and the little bit of repairs that we did – the FHA could have flat-out denied the loan. At that point, I would have had to scramble – again – to find another end-buyer, all the while paying incurred property taxes and sitting on the deal.

Thankfully, that’s not what happened.

Again, this is a lesson on why you should always have a healthy buyer’s list at the ready.

And here’s why I think the FHA was quick to green light the $20,000 difference. It’s simple, really…

See, the FHA was okay with the difference simply because the property appraised for so much more than what I was selling it for. I was selling it for only $80k, but it had appraised for $100k.

The FHA was comfortable with that… and you better believe I was, too!

How does this impact you and your business?

Now, you might think that the FHA asking for price justification is a new thing… but it’s not.

It’s actually a typical request.

The very first deal that I ever did in 1993 was an REO property that I bought, rehabbed and then sold to an FHA buyer. Well, even way back then, the FHA wanted me to justify why I was selling the property for so much more than I had bought it for.

My point is, this request from the FHA is nothing new. You will possibly experience this situation for yourself if the end buyer in your deal brings the FHA to the table.

And you might be wondering: “How does this affect me?”

Well, the bottom line is this…

If you’re wholesaling REO properties to another investor, you likely won’t come face to face with the scenario I shared with you, at all, because investors don’t typically have the FHA insure their loans. So this whole thing is pretty much avoidable if you stick to wholesaling houses .

But remember, the trick is to sell cheap. Could I have sold the property for $100k like it was appraised for?

Sure. But it would have likely taken longer. I was perfectly happy selling it – quickly – for $80k and banking $20,000 plus – the earnest money deposit the first buyer forfeited.

What I’m saying is – get that appraisal up, get the deal done quickly, and get out.

And remember to maintain that solid buyer’s list, and always – I mean always – have back-up buyers.

If you have any questions or comments on how to wholesale REO properties, please feel free to leave any comments or questions below. I personally monitor and respond to them.

Best Regards,

Cameron Dunlap

P.S. Do you have any “bumps in the road” stories related to wholesaling REO properties? I’d love to hear it in the comments section below.

Great post Cam. Not only are you consistently outstanding in running your businesses, this post shows that you are able to drill deep (to whatever level you choose on a given topic) –in this post the importance of having not only a ‘Buyers list’ but one that is responsive”. By illustrating why that is important you refer to a real life example of your own to show why a responsive Buyers List is essential.

Many thanks for your consistently sharing valuable ” in the trenches” information with us.

Thanks Cam,

Good Story, Good Advice.

Ron

Hi, Cameron!

I have read your info about this posted blog on a REO Deal, you you didn’t say:

1. The plumbing cost and how long it took to replace/repair the frozen pipes

2. the closing fees cost, etc

Edmo, the cost to repair the plumbing and related damage was about $1500 and closing costs also were about $1500. Your costs will vary of course.

Im new to wholesaling, and i been teaching myself which is hard to do by watching different youtube videos thats the best i can do, but i want to learn the business. But any ways from watching the videos some of the guys teaching say that REOs are hard to wholesale because of the 70 – 75% arv they say most banks wont sell for that, now im confused because you say they can be good deals, which is it should i stay away from them or work them, and if work them how do you work the deal because i have noticed on the deals i have bid on my price is always a lot less than what they are asking in some cases 50% some time more. How do you close the gap with the bank to get him or her to take the deal, and please show an example do you still use the percentage of arv is it higher what is it that closes that big gap in most cases. if you can shown an example. Thank you Mr Dunlap my name is Matthew

There are great REO deals out there but you have to pick through the masses to find them. It also depends on how competitive your market is. Keep in mind I do deals in 4 different markets. You will also need to be ready, willing and able to have many, if not most of your offers rejected. Get comfortable with that, learn not to take it personally and plan on making lots of offers, all the time.

Well done Cam. Very resourceful as always. Thanks for the pointers. Are there any more to share?. I am always ready to learn every bit from your vast experience. Thanks for being there for us.

In the funding program, it states that you don’t fund deals that involve FHA VA. Please explain so I better understand. Thanks Fred……. (Shotgun guy from San Diego)

Hey Fred. I think what you’re referring to is that we don’t fund deals where your end buyer is using FHA or VA backed financing. As far as you buying from FHA and VA and then reselling to a cash buyer, have at it – we do that every day!

Thanks for sharing that info, Cam!

Bill and I got a house under contract in our area on the promise a local real estate broker would buy it ( for a flip) and we could do a double close in a few days time. What we did not realize is that our real estate broker buyer, who we had put too much trust into, actually did not have the funds to buy the house. A few days went by and no answer from him and since we had no backup buyer… We let the deal go. I felt like a total failure and a big idiot. Your point of having a good backup buyer list might not seem important in the onset of doing your first deals but trust me! LOL your advice for a good buyers list will save the day and a nice paycheck to boot! The moral to our story is this: just because they are a real estate agent or even a broker does not mean they are not flakes! Lesson learned!

Cam

Awesome content. My bump in the road dealing with REO houses is, I received some houses from broker houses and I’m learning there is a daisy chain some time dealing with them. How do I get directly to the seller? I’ve received properties from Hudson & Marshall (hedge fund). How do I by pass this daisy chain?

Buying direct will be the exception rather than the rule, for sure.

Thanks for this Cameron. Can you still flip REO in 2019. How do you get paid as a Non-License Real Estate Investor on the HUD @ closing. Most banks demand the properties be listed with a license broker. I can get REO lists. So do I contact each broker and see if they would work with me as a wholesaler who has access to cash buyers. Most Realtor want earnest money. How do I close w/out earner money. Should I have my cash buyer put up the money. I’m just flipping my contract right. Thanks for all you do.

You can absolutely flip bank owned/HUD properties. Just not using an assignment. You’ll need funding. They’ll almost all be listed and that’s fine. You will need earnest money when dealing with bank owned properties. If that’s a problem, focus on houses owned by private sellers. Earnest money is required with them too, but you can use far less in many cases. You cash buyer should not know about the property until you have it under contract. Flipping the contract is an assignment. Banks don’t allow that. Private sellers often do.

I thought you couldn’t wholesale bank owned properties? You can’t assign the contract so I’m guessing you would be using transactional funding yes? Close with the bank and then close with your end buyer right?

Thanks Cam

Bingo! You nailed it Steve.

Hi Cam. You say you add to your Cash Buyers List by going thru the data feed every month. How do you pick buyers from the list?

Also, when your REO deal fell thru, you went to the buyer who had offered $80k and then closed that deal. Why didn’t you sell to that buyer in the beginning instead of the $75k buyer?

Thank you.

I think it’s the opposite approach I look at what the cash buyers are buying and where – which is a bit like having a crystal ball. Then I focus my buyer efforts on those areas.

I sold to the back up buyer because the first buyer bailed on the deal. The backup buyer, at 80k, came via my marketing, after I put it under contract for $75k. At that point it was too late. When that $75k buyer flaked out, I was able to sell to the back up buyer – which fortunately was willing to pay more!

Yes, thanks Cam.

Is it feasible to do a double close using your family bank funding to move an REO? What do you do about EMD; can you get the end buyer to pay?

Absolutely we can fund REO deals. The earnest money is down to you. Your buyer will need to provide an EMD to you when you find them, but that comes 2nd.

Hope this helps,

Cam