(The Simple Way to Appraise Houses Quickly)

There’s incredible power in simplifying…

Doing your own property value estimate will save you time and money.

It seems daunting to estimate the value of hundreds of properties, so most investors stop right there.

And in order to be a pro wholesaler… you have to master this. If you are 1% off… that’s $1,000 on a $100,000 house. If you are 10% off… that $10,000.

Not only will you make less mistakes, you will save time…

When I got started I made the same mistakes that most novice investors make and one of the biggest mistakes I made was spending too much time determining the after-repair value of each house.

I remember one time I brought my sleeping bag, a picnic basket, and some tunes and spent the evening picking the house apart to find my house value.

I analyzed every aspect of the deal imaginable… and guess what?…

I still wasn’t perfect to the dollar.

There is an albeit simple art & a science you’ll need to use when it’s time to find your property value, but even if you were the best in the business… you will not be exactly right, the majority of the time.

It always boils down to… what a buyer is willing to pay for a property.

You can’t predict with precision how much a buyer is going to be willing to pay for a house… because you are analyzing months in advance… and the investor who buys the house from you may have a wildly different vision than you (and the comps that are available to you).

The Trick Is To Do The Best You Can In The Quickest Amount Of Time Possible.

Find houses in the area that are comparable.

Look for houses in excellent condition, as close as possible, that have sold recently, and share the same features and benefits.

This article is about estimating home value on starter homes. There are lots of entry level houses in every market and finding comparable homes should not be very difficult.

If you are not an appraiser, don’t worry. They have to give every detail in large part, because they are performing this service for a national bank or for a home buyer who is using bank financing. The lender wants to know everything they can about the house but they do not have the advantage you have of being in the local market.

They don’t know the area, they can’t drive by the house, they can’t walk inside the house, they can’t measure the square footage… so they need a licensed and regulated professional to tell them all of this information.

The bank will certainly not trust the buyer’s opinion of value, and since brokers are commission based, the bank doesn’t even know if they can trust them.

So while an appraiser’s real estate valuation may be more accurate than yours… all you should care about is the after-repair value so that you can make the right offer.

Getting the house appraised is unnecessary and a waste of a few hundred dollars if all you’re trying to do is find out the ARV.

Your rehab investor buyer will come up with his/her own opinion of value, their broker will come up with his/her own opinion of value, the buyer who eventually moves in will have their own opinion, and the appraiser hired by the buyer’s lender will give their opinion too.

There are a lot of opinions being tossed around here and who knows… yours may be the most accurate by the time it sells.

You are not going for perfection here… you are going for “what you realistically think a retail buyer would pay for it”, so you can work your numbers and make an doffer that allows you to make money as a wholesaler.

Your time is valuable and you need to act that way.

Don’t use the time-intensive method that novice investors use (analyzing every

detail). Instead use the method below, which took me decades to hone in on and perfect.

Condition

Your buyer (the rehabber) is most likely going to do a major renovation. By the time he/she is finished… the house will be like new.

At my live events, I ask the audience for participation and when I survey the appraisers, they say that they usually calculate house value 10% higher for a fully rehabbed house than a house in average used condition.

If average used condition houses are selling for $100,000 in your area then a freshly rehabbed house in excellent condition should sell for $110,000… you need to know that.

Make your offer based on the future value being $110,000 not $100,000 (like novice investors do). You will lose deals if your offers are TOO low.

Proximity

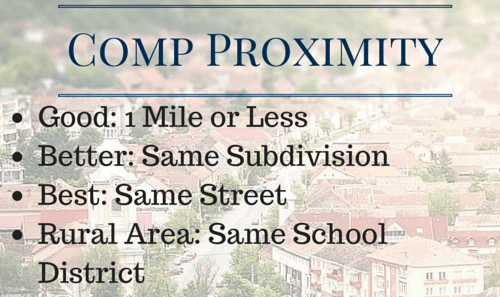

How close is the comp to the subject property?

You want it to be within 1 mile for sure (unless you are in a rural area). Ideally, you would find a comp in excellent condition on the same street. But, if you find a house in excellent condition that is in the same subdivision, that works well too.

Here is my rule of thumb:

Recency of Sale

A house that has sold within the last 30 days is more relevant than a house that sold 1 year ago. I hope this hits you as common sense.

Imagine you are shopping for a new computer… would you be willing to pay as much for last year’s model as this years?

In Real Estate, values appreciate and depreciate. Depending on which part of the cycle you are in, the value may be higher or lower than a house that sold 1 year ago. You want to use the most recent comps possible.

Here is my rule of thumb:

Size & Amenities

Have you ever heard the saying “location, location, location”?

This is where that applies.

If the subject property that you are considering making an offer on is on the lake and the comp you see is in a bad area… they are not comparable.

If the subject is on a busy street and you are looking at a comp in a tree-lined neighborhood… they are not comparable.

Look for houses that are in a similar quality area and similar in size:

- If the subject is a 3-bedroom house… the comp should be a 3BD

- If the subject is a 1.5-bathroom house… the comp should be a 1.5BTH

If you just cannot find a comp that is alike, then use the best one or two available and make the same adjustment that you think the eventual buyer would make.

PRO TIP: If you run into a large 2-bedroom house…. Ask yourself “where’s the 3rd bedroom going to go?”. A 2-bedroom house that can be converted is more valuable than a 2-bedroom house that is not convertible.

Other items that should be similar:

- basement

- garage

- lot size

- swimming pool

- style of the house (ranch, 2 story, colonial, etc)

- age of the house (should be same decade)

- construction of the house (block, poured concrete, slab, etc)

The junker is a small ranch in bad condition

The pretty house is a 2-story Colonial that is in excellent condition

These houses are not comparable.

Look for houses with similar features and the major difference being the condition. Then, you will have a good idea of how much the “junker” will be worth when it’s “pretty”.

PRO TIP: When you want to add a bathroom, know that more work needs to be done if the house is built on a slab vs. on a basement.

The last thing you need to know when comparing the size and amenities is square footage… I see people using SF to analyze the value quite often. They say if the average house is 1,000 SF and it sells for $100,000 on average… then mine is worth $120,000 because it is 1,200 SF.

But averages are just average. I want the BEST data.

While it is a good scientific approach… the ART of the evaluation is left out.

It does not take into account what the extra space is used for or the emotions the buyer is feeling when they go through your house, in comparison to the average price per foot in your market.

Since emotions sell, I do not rely on SF analysis.

But, I do look at SF. I want to make sure the comp is within 100 square feet, give or take. If the subject house is 1,000 SF, I will only look at comps between 900-1,100 SF.

The condition, the smell, the layout, the quality of the neighborhood, the quality of the kitchen, and the overall ‘lifestyle vision’ the buyer has when they see your property for the first time will have a far greater impact on how much they are willing to pay, than what the exact number of square footage is.

Last but not least:

SO, Where Can You Get Comps You Can Rely On?

As part of the iFlip Real Estate System, users are able to access my exclusive Custom Comps tool. So, not only does iFlip allow you to completely automate your real estate investing business so you can do more deals more often, but you also receive access to industry leading comp data too!

Now, of course since I developed this powerful tool for myself and my clients I know my opinion may be slightly biased so here are a few alternative methods in descending order of preference:

- MLS

- If you know a broker or you have access to the MLS… you can see all of the houses that have sold through a broker. Note that many MLS’s do NOT include private sales where a broker was not involved. This is a significant limitation.

- Title company

- Once you have established a relationship with a title agent, they may give you access to a portal of their site to pull the profile on any given property.

- Subscription services

- This would include SiteX, RealQuest, and other software programs you can order online that will provide you with the same information iFlip does… but it will cost you more money.

- Free comps tools

- This would include sites like Zillow, Realtor.com and similar outfits that give you data.

- Tax assessor

- The government determines how much you pay in taxes for your house depending on its’ value. But that assessment can be wildly inaccurate.

One important thing to note and that makes iFlip a very powerful resource is that the comps we provide within the Custom Comps tool include houses sold through the MLS and those sold outside of that environment. So we have all the data including private sales. This makes iFlip an invaluable and fully complete resource.

At only $79/month you can get instant access to a system that was designed to help you automate your investing business from A-Z, plus all custom comparable data you can count on… no matter what market in the U.S. you live in.

And for a limited time, you can try it for $1.95.

Yep, only $1.95 to try iFlip for 30 days. This way you get to test it first and make sure that you love all the tools available to you within iFlip as much as I think you will.

The truth is once you learn to value a house properly it’s pretty easy. In fact, the time it took you to read this is longer than the time it will take you to determine how much your house is worth once you get proficient at it.

If you are looking for a more in-depth training on how to flip a house quickly, using none of your own cash… click here to visit my recent blog post on flipping houses with no money, credit, or experience (in 30 days or less).

Or if you have any comments on this article, please leave them below. I will personally respond to you as soon as I can.

Regards,

Cameron Dunlap

Very good information here. This could save my butt in this business.

Hi Cam, I live in New Mexico, which is a non- disclosure state. How does I flip get comp values for houses in such states?

Yes, we have last sale info on comparables in NM. Please test the data here http://www.PropertyValueTool.com

Great, concise article, thank you!

Sounds like a winner. After using some of the other avenues, we need more precision. These tool alone might increase our sales.

I USE REDFIN FOR MY COMPS.

How does this tool differ than prop stream? Is the data different and/or better? If so, how?

Jon,

Thanks for asking. First off, let me say that I never like to disparage another company and, frankly, I don’t know what competitors are doing to make their data useful to their customers.

We however take the data that we provide to you very seriously. We have multiple data scientists on staff that help us clean, parse and identify the most valuable data while removing “junk data’ that can cost you valuable time and money. We also approach the data game from an “Investor first” perspective, which can be hard for companies whose leader hasn’t been an investor for 25+ years.

Lastly, I want to make clear that we do not have a white label of Prop Stream’s (or any other services) data, where it’s “the same old data in new clothes”. We go straight to the sources ourselves and spend the time and money to get the best possible data available. I encourage you to try it out and see for yourself how we’re doing things.

Good background information. Because multiple sources give multiple results. Thanks!