How do you know if an investment property is a truly GOOD deal?

I get this question often and the answer is…there are several simple, yet effective, ways to figure out if an investment property you’ve found makes sense as a deal for you.

Let me be very clear, it’s not about whether I LIKE the property. That has absolutely nothing to do with it!

Pro Tip: Take emotion out of the equation when evaluating an investment property.

You see…to me, these houses are simply inventory. In fact, some of the deals I do these days are on investment properties that I’ve never even seen.

For me, whether to do a deal or not is determined by looking at 5 significant factors – after I’ve used these to evaluate the property, I’ll know if it’s a good deal or not.

Now, let’s dig into the 5 factors that you should look for…

#1: A Highly Motivated Seller

In many cases, we’re dealing with a highly motivated seller. For instance, it might be a vacant house, an absentee owner, a foreclosure situation, a divorce, probate, etc…Any of these can lead to you buying at a deep discount and other than in unusual cases, if we’re not buying at a discount, we DON’T buy at all. Period.

Just know that there are 2 types of sellers:

1) Those who want to sell.

2) Those who need to sell.

We ONLY want to work with the latter.

Remember…there are all kinds of motivated sellers…absentee owners, vacant houses…even HUD and the banks are motivated sellers. Being motivated is a vitally important part of our criteria.

Motivated seller resources:

- Motivated Seller Data Feed – Use this to find over 5.7 million ultra-motivated sellers nationwide. With the ability to target up to 20 motivated seller types (including vacant houses, absentees, foreclosures and more) this is the most powerful motivated seller resource to date!

- Vacant House Data Feed – Use this to find verified vacant house leads nationwide. There are more than 1.7 million of them hiding in plain sight right now. (You can even get phone numbers on a lot of them so you can start contacting sellers immediately!)

- Absentee Owner Data Feed – Use this to search for absentee owners in your area (or across the country.) This is MUCH easier and more affordable than any other absentee owner source I’ve found!

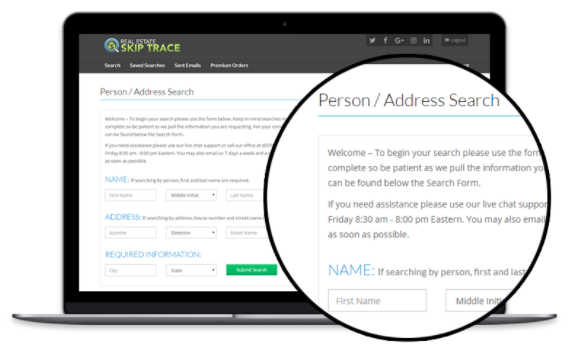

Often, motivated sellers that we identify can be hard or almost impossible to locate. Why? Well, it all goes to back to the reason they’re motivated in the first place. They may owe money and be avoiding creditors or they may be going through a divorce or probate and they don’t know that selling the house fast is even an option. Whatever the reason for their motivation, if YOU can’t easily find them, then, more than likely, neither can your competition!

To resolve this particular issue, you’ll need to run a skip trace. I use Real Estate Skip Trace on all hard-to-find owners that my competition can’t touch.

#2: Needs Repairs

If the investment property is in need of repairs, that allows for an even deeper discount.

Repairs drive the price down further than it actually costs to do the repairs. So, for every dollar of repairs needed on the house, we will take the discount down by no less than $2.

#3: Good Location

Of course, this one should be ingrained in your mind…location, location, location.

The location MUST be a good one in order to be a good deal.

The investment property has to be in a place where people (mortgage-qualified buyers) actually want to live.

#4: Appeals to First-Time Home Buyers

If the investment property is affordable and in a place where people want to live, then it will most likely appeal to a first-time home buyer!

First-time home buyers have access to the only free-flowing mortgage money in the marketplace right now. In fact, if you’re looking to buy and sell houses—wholesale or rehab—I can’t stress strongly enough that you should stick to entry-level houses.

Here’s a great example…

One of my contacts was raving about an investment property that was worth $2 million. It had been on the market for 5 years and could be snapped up for just $750k. He asked me if I wanted to partner on the deal.

My reply:

“The reason it’s been on the market for 5 years is

because it’s overpriced. Even if we did buy it, how many buyers

are there for a $2 million house?”

You might be asking, “How is this such a great example for this particular factor?” The answer is because as the price of a property goes up, the number of people who are capable of buying it goes way down. What we’re talking about here is declining demand equaling declining liquidity. Or to put in layman’s terms… we should fish where the fish are!

#5: The Numbers Work

The final reason is because the numbers simply make sense.

First, we look at all the comps…

I know what it will sell for after repair, and I know the cost of repairs, so now I know the price that I will not exceed. If I can’t buy it for that price, or less, I’m not going to buy it. Plain and simple. It’s a no.

We can NEVER pay too much for an investment property, no matter how much the seller may try to steer us otherwise.

Beware! A Realtor will want you to pay too much. HUD will want you to pay too much. Just about everyone wants you to pay too much. You must be the tough one who holds the line and says no – after all, you’re basing your decision on the numbers…which, as they say, don’t lie.

Final Note

Remember, it’s never a good idea to become emotional about an investment property. Things will get messy if you do!

Keep in mind, it’s JUST inventory.

Always be sure to take emotion out of the equation.

Your Turn…

Do you have another tip for determining whether an investment property is a good deal? Have you ever gotten emotions involved in a deal? How did it turn out for you? Leave your comments below. I’d love to hear your thoughts!

Regards,

Cameron Dunlap

Knowing what they rent for and the vacancy is in the community. Knowing where your rental client comes from. It is a cool job . I like beach rentals . Why not do your job by the beach where it is fun……

Fell in love with an auction property because of updates and area. Come to find out we did not research the ARV enough and the spread was not even good enough to wholesale. I couldn’t even get a loan on it without paying 15%+ down. I think the property was cursed! Luckily I warned the bank multiple times to winterize the property and they failed to do so. 3 snowstorms later and pipes on both floors were busted and it was flooding EVERYWHERE! I told them to return my EMD or give me a better deal and they decided they would return EMD and resell. They later auctioned it to some other sucker(probably a buyer I advertised it to) for 5k more than I paid for it. I am sure they likely won’t close on it either though………

I’ve been saying that a house is like a used car. Establish minimum sale price. Deduct profit, cost to bring it to AMV. I know I oversimplifyl, But Years ago I read a training book for used car managers, put out by Nissan. The whole gist of the material? Buy low, sell high. Thanks for you continued notes. Now, all I need is capital!

Thank you Camreron. Great information