Welcome to Part 2 of HUD Homes 101: What Every Real Estate Investor Needs To Know

In Part 1, we went over what exactly HUD homes are, how they’re located, the bidding process and the importance of the Proof of Funds letter. (By the way, those POF letters are provided in my REI Trifecta program, click here to check it out and start generating your own verifiable proof of funds letters now!)

In part 2, you’ll learn about the inspection period, gaining access to the property, closing the deal (so you can get paid), as well as must-know information about working with Realtors.

Are you excited?

Let’s get going…

Pricing Your Bid

So, you’ve found a HUD home you’re interested in…

Now how should you calculate the percentage of the bid of the asking price?

Well, for me, I believe that 82% of asking is a safe place to start.

If 82% of asking isn’t low enough to make the deal work for you, then you really have 2 options. They are 1: Move on or 2: Keep an eye on it because if it doesn’t sell, HUD will lower the price.

While this“82% rule” is a reasonable place to start, it may vary in your particular market. This is another one of those things that you’ll learn to dial in on as you go along!

Your Offer Has Been Accepted!

We’re now at the point where your HUD home offer has been accepted.

What’s next?

There will be an inspection period, after which you’ll have 35 to 40 days to close. Because of the way our Proof of Funds letter is written, the very specific and carefully chosen words in it, your offer will be viewed as a cash offer. This differentiates your offer from any others that include third party financing. Your offer is superior.

This is important because it gives you massive LEVERAGE.

Most lenders require a 5, 7, sometimes even 10-day inspection period. At the end of that time, you have the opportunity to either accept or decline that property.

Because you’ll have already inspected it—after all, you already know you want to buy it—you can take advantage of this time to search for your buyer, assuming you plan to wholesale it. If you’re unable to find a buyer during the inspection period, you can simply walk away from the deal and take back your earnest money deposit, stating that the property is unsatisfactory.

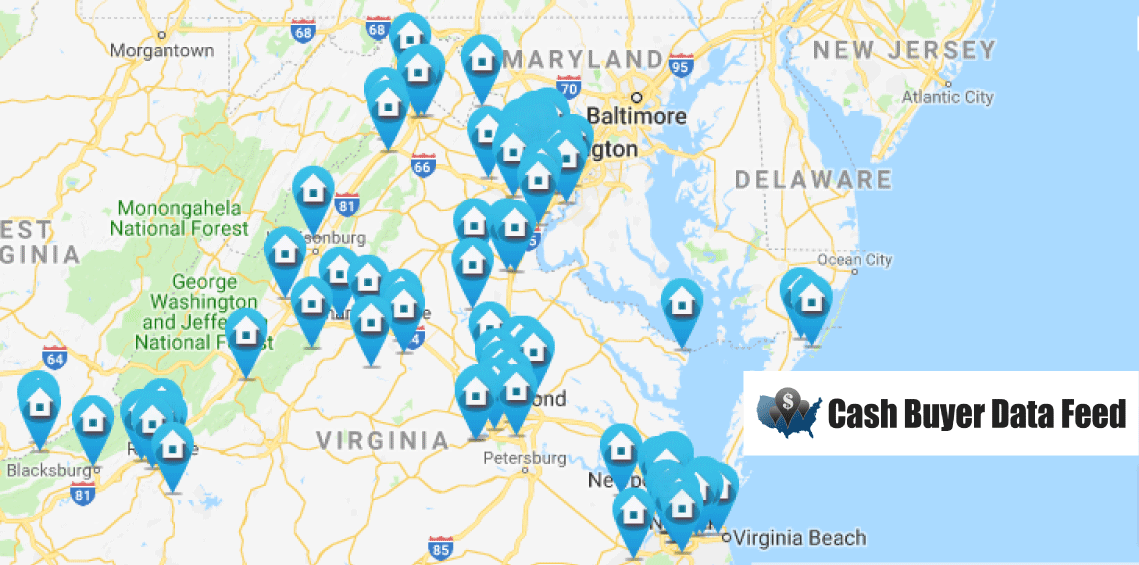

One quick way to find cash buyers is to use the Cash Buyer Data Feed. It provides you with cash buyers across the entire country, including your area, and offers advanced filters to help you pinpoint the exact type of buyers you are looking for. Run a FREE search here!

Importance of Your Realtor

During this process, you’ll want to lean on your real estate agent.

When they understand that this is not going to be your last (or only) deal, they’ll be in your corner supporting you! You become an extension of them, and them of you. It’s a partnership that is highly valuable to both of you.

Different regions of the country may handle HUD deals differently. Your agent will know this – just one more reason your working relationship is so valuable.

That Realtor NEEDS to know that you’re in business and may be making many HUD purchases in the future. To them, that’s like an annuity!

The Closing

At closing time, when you’re wholesaling, there’ll usually be 2 closing agents.

HUD typically prefers that you work with their choice, and the buyer will probably want to work with theirs. I experience this type of situation all the time and it’s no problem, but it’s easier when the same closing agent handles both transactions.

HUD may require that the buyer’s (your) funds be in escrow prior to close, which runs outside the parameter of the funding we provide but…in spite of this, we do this quite often under a couple of different scenarios…

ONE – is if the local office agrees to the funding arriving on the day of closing—which often happens when we push back a little bit.

SECOND – is when your buyer’s funds are in escrow and all their documents are signed and held by the closing agent. This means there’s no additional risk to us by sending the money in a day early, since the transaction is nailed down. When that’s the case, we’ll go ahead and fund even if it’s the day before, just as a matter of routine. Try that with another transactional funding source! Then ask them to do it with NO fees like we do.

If we wire the money today and the transaction happens tomorrow, but because of time zones we don’t get the money back until the following day—that means the money is actually out for two days. That’s a BIG no-no in the transactional funding world.

Given this particular scenario, we can work with that type of situation with some extra planning.

The main thing to ensure is that we’re protected, and that the transaction is set in stone.

>>For more information on our funding and how you can get access to $1,000,000 for an unlimited number of transactions, click here now!<<

Getting Access to the Property

Getting the buyer in the property used to be a stumbling block for me because I couldn’t see how it would work.

But…it’s really very simple.

Pro Tip: It’ll be useful if you have a good relationship with the agent you’re working with!

One way is to put language in your agreement that provides you with access to the property prior to closing in order to show it to potential contractors, rehabbers, and so on. Your agent can help you with this wording.

Or, you can get the Realtor to give you the key! It depends on your market and the agent you’re working with, but generally speaking, HUD has their own lockboxes and they re-key the houses to each region or city. Periodically they will change them out.

I have one realtor who handles HUD homes in my area, and he mails me the new HUD key when they change it. There’s no way he wants to drive 3 hours round trip just to show me these houses!

In my experience, I find there are usually 2 types of Realtors:

- Some are focused on protocol – that’s the one who wouldn’t dream of giving you a key.

- Then there are those who are focused on productivity – that’s the one who can’t imagine not giving you a key to HUD homes.

Over time, you’ll get to know different agents, how they work and what they’re comfortable with, which will make the process much smoother in the future!

Take Action

On a final note…there’s no substitute for getting out there and actually starting this process!

You can sit around and wonder how and wonder why, and try to figure out all the things that could go wrong and all the challenges that you may face…

Next thing you know, years have gone by and you haven’t done a SINGLE deal.

Or…you can get up, get out there and just start doing!

You’ll learn the process of HUD homes as you go. You might make mistakes along the way, but so what? It’s amazing how much you learn by DOING. So, get out there now and start doing. If not now, when?

From Your Point of View

I’d love to hear about your HUD home experiences. Please leave your comments below!

Regards,

Cameron Dunlap

I am interested in a hud home in Killeen or Harker Heights Texas. But can I just go to any agent? And how am I paying for this?

Dana, you’ll need to find a HUD approved agent in the area to help you with those. You’ll find a list (although I do not know how complete) at HudHomeStore.com

On funding, it will depend on your exit strategy. My opinion is: If you’re wholesaling, our No Fee Funding is available. If you’re rehabbing, you’ll want to secure a Hard Money Lender or Private Lender. If you plan to buy and hold you’ll want a private lender.

Oh, I think I may be able to handle this! 🙂 I’ve seen a few good HUD’s in my NJ area. Now, to get the agent who’s investor friendly…and fixing my credit “hacks” that messed up my score. Thanks Cameron. I’ve bookmarked this.!

Any suggestion on Hud home broker? Need 1 to bid on Hud. What exactly to expect and specific criteria need to look around hud brokers?