In this article I’m going to look at making offers on houses that are owned by private sellers – as opposed to bank sellers.

One of the biggest issues investors have when doing deals is with the process of making an offer on a house.

They are taught to add contingencies or “weasel clauses” when they make an offer, like “subject to partner’s approval”.

However, I have a strong difference of opinion…

You see… if you put yourself in the seller’s shoes, you can easily understand why contingencies in a contract don’t make sense.

Let’s think about it…

If you own a beat-up house that is vacant…your most likely reaction is to do nothing.

Maybe you are embarrassed by the house… maybe you don’t have the money to fix it up… maybe you inherited the property and live in a different state.

Whatever your reason, you are probably confused… and a confused mind does nothing. It’s how we are wired as humans.

So when you receive a message from me that says I will buy your house for cash, as-is, on the date of your choice… what do you think your most likely response will be?

You would be excited, hopeful, and even shocked (that someone wants this house that you saw as a “problem house” for whatever reason).

But as a home owner, if you receive a house offer from me that includes contingencies that make the deal subject to things like: appraisals, home inspections, partner approval, or the myriad of other “weasel clauses” that newbie investors use… you may just change your mind about me, right?

As a seller, your mind begins to go down a different path. You’ll go from being excited… to doubting, and you may even begin to research your options.

Sellers will start seeking out any competitors who will offer to buy for the same price, but with no contingencies.

Now that you know what not to do, let’s dive into what TO do so you can start getting more deals done and cashing more checks…

The 7 Step Guide to Making an Offer On a House

(Remember… we’re talking about houses owned by private sellers. Bank sellers are very different!)

- Make the Contract Assignable

If you are using a Realtor contract,there is probably language that prevents you from assigning the contract (or a checkbox that asks you if the contract is assignable). But, in order for you to make quick cash without using your own money, you have to be able to assign your contract, so that needs to change. You can change the language in the Realtor contract, hire an attorney to create a customized contract for you, or you can use the same contract I and many of my students have been using for years inside my “Purchase & Sale Agreement Line By Line” course. An old school method is to put the words “and or assigns” where the buyer is named. So it would read “ABC Real Estate Solutions, Inc. and-or assigns”. This works but can raise questions in the eyes of the seller, which is, as mentioned above, not a good idea.

- Make a Cash Offer

The buyer you wholesale the property to should be paying cash for the house, so you can ethically make a cash offer. By doing this, you make the seller comfortable because they know that you are not going to a conventional lender who would not approve this house for a conventional loan because of its condition.

- Close on the Date of Their Choice

One big mistake that most investors make is saying, “We’ll close fast” or “close in 10 days” in their marketing for motivated sellers.

Sometimes sellers want to close as fast as possible, while other sellers need to make some arrangements and therefore DON’T want to close fast. By being flexible on the closing date, you are accommodating sellers in any situation.

One time I was working with a motivated seller who wanted to close in 90 days. She needed time to find a trailer for her sons. I drove through a trailer park and called the FSBO sign on a property that looked like a good fit. The seller happened to be across the street and he showed it to me immediately. He wanted $5,000 for it… and she wanted to pay $5,000. So I offered him $3,000 and got it. I wholesaled it to my motivated seller and made a couple extra thousand dollars. Not only that, she was ready to close right away, so I didn’t have to wait 90 days to get paid on the first deal.

When you use the phrasing “close on the date of your choice” in your marketing you’ll find that more doors of opportunity open up for you.

- Earnest Money

I rarely use more than $10 for earnest money when working with private sellers. Sometimes I go up to $100. Sellers really don’t care! Most would never even mention it, if I didn’t bring it up. And the reason I bring it up is because money serves as a definite means of consideration. In order for a contract to be enforceable, “consideration” is required and nobody can argue that money is not consideration. I use the word “legitimate” when I describe this to a seller.

If you are working with a bank, the earnest money is usually at least $500 or 1% of the purchase price (whichever is greater) and you don’t have as much flexibility with institutional sellers. While it is part of the negotiation, they have had TOO many deals fall apart and they want you to have “skin in the game”.

- Proof of Funds

With banks, this is a requirement. They want to know that you have the means to close. They want you to prove that you have cash available. With private sellers, this is practically a non-issue. I have had a few ask me to prove my ability to fund, but it is very rare.

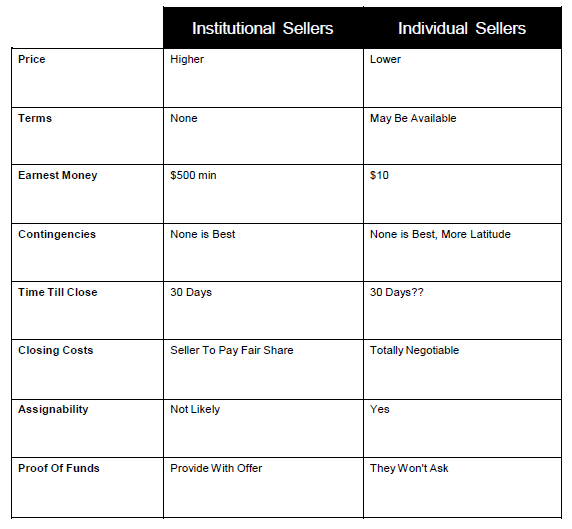

Here is a matrix I put together to help you understand the differences between private sellers and bank sellers:

If you don’t have the funds available in your own personal bank account there are ways to still get valid proof of funds letters to do your deals. In fact, that’s one of the many benefits inside my “REI Trifecta” Program.

- Presenting Your Offer

Faxing or emailing your offer to a seller is acceptable. If you live in another state, it is usually the only way these deals get done. But, if you live locally, I would highly recommend doing it in person. If they can shake your hand, look you in the eye, and they like you… there is a higher probability that they will sell to you, at your price.

If you are a “virtual” person, they may have questions and doubts that never get reconciled because you can’t see the look on their face when they read the contract. You may not like the idea of presenting a low offer in person, but I will tell you, they aren’t getting any other offers AND they are well aware of the poor condition and the high price tag to fix the house up. In my experience, the seller thinks the house will cost twice as much to fix up as what my buyer can get it done for. So while it may feel to you, like you made a really low offer on the house, they may think it is really fair.

- Submit Your Contract to Your Closing Agent

Once you get a signed contract with your seller, send it over to your closing agent or Real Estate attorney. I prefer to use attorneys on all of my transactions (even for my deals in non-attorney states). Attorneys add a layer of protection that I am comfortable with and they handle all of the paperwork (so I don’t have to). Once you turn your contract in to your attorney or closing agent, you are ready to find your buyer and get paid!.

**If you DO NOT already have a list of cash buyers for your deals you will want to try out the Cash Buyer Data Feed. It’ll give you instant access to all of the cash buyers in your area (and around the country) that are actively buying properties for cash. We are currently offering a FREE search to see how many cash buyers are in your market!

When putting an offer on a house your job is to make it easy for the seller to say “yes”.

The value you bring to the table is a quick, hassle-free offer to purchase that has a high probability of closing.

The right seller – a motivated seller will see real value in your solution.

Pro Tip: Truly motivated sellers are willing to trade equity for peace of mind.

For example, I once received a call from a probate attorney who said they needed a quick real estate offer. I would have paid $150,000 for this house but when I asked him what they were looking for, he said $85,000. I was super excited…until I heard that the neighbor was making an offer on the house too. I didn’t want to get into a bidding war so I asked the attorney for more info and found out that the other offer had contingencies. Not only did my offer on the property not have any contingencies, I went one step further… I made my earnest money deposit in the amount of $85,000. This guaranteed them the cash they wanted for the house… and whose offer do you think they accepted? Yep… mine!

There is only one contingency that I use (and I would always recommend for every buyer no matter what kind of deal)… clear title.

I ALWAYS want (no, NEED) to know if there are any other liens or encumbrances on the property. If I put down $85,000 in earnest money and find out at closing that there are $200,000 worth of liens on the property that the seller did not tell me about… I am in big trouble!

I have never had a seller complain about checking title… it is common practice… and if they had a problem with it… that would be a big red flag and I would quickly back away.

Follow these 7 steps to making an offer on a house and you’ll find that you get more offers accepted, which of course means more profits in your pocket!

If you would like a complete guide on flipping a house with no money, credit, or experience (in 30 days or less), check out my blog post on Flipping Houses With No Money.

What was your biggest takeaway? Leave a comment below… I’d love your feedback and I always respond personally.

Best Regards,

Cameron Dunlap

Great info… Just have one question? Why does the Purchase and Sale contract in I flip have all of the contingencies that you said should not be in the agreement???

It’s a generic agreement that you’ll want to customize to your particular needs. Have at it!!

It’s been quite a while that I joined your system.

It’s only now that I am able to partake of the

benefits.

This is to thank you to the Nth degree for the

substance that you share with your members.

It’s about to assist in getting me to where I now

need to be in the path of success.

This Blog you have shared is an example of that

substance.

My most sincere appreciation.

My immediate thought is, I was surprised when you said know contingencies but for some reason I felt a relief. Then you surprised me with the $85,000 earnest money. I said to my wife he bullied that other buyer but at the same time I couldn’t imagine the seller saying know to $85,000 earnest money. Backing off the bully, it was a challenge and an opportunity. You had the ability and nerve to take the challenge, plus you had the someone depending on you to come through, and you did.

What should it say in a contract

To make it legal and Legal Binding when it is being Fax or emailing your offer to a seller is acceptable , AND LEGAL BINDING

THANK YOU SO KINDLY

FOR YOUR WONDERFUL HELP

I AM MOST MOST GRATEFUL

SINCERELY YOURS

You don’t need to say anything in the agreement to make it binding by email or fax. As long as there’s a signature on it, it is. Your closing agent may want a “wet” signature as part of the closing package but that will be up to him/her.

Hey Cam.

I just got your Motivation Data Feed. Would it look better, more professional, not to use the “and or assigns”, and just use your funding with the A-B-C closing?

Christopher Hall

In general I would say yes to your question. An assignment is easier as there are less steps but it’s less popular all the time with closing agents, and can be tricky to explain to sellers.

Such a great article for a beginner like me! Thanks so much, Cameron!

Kind regards,

Phyllis

What do you do when you tell the seller, “I will buy your house for cash, as-is, on the date of your choice” and they want to close that day, the next day or in a week?

The next day is simply not realistic. Within a week is, so long as your closing agent doesn’t mind, or is compensated for rushing the process.

Great blog Cameron,

I will make sure you get my timely feedback as soon as I will have the 7 steps in real time practice.

I have no words to thank you.

Thank you for this valuable information, Cam. How do you explain to the seller who questions the “and/or assigns”?

Be upfront. If they don’t like it, close and resell using our funding.

You mention closing at the sellers desired time frame. My concern is having enough time to find a buyer. I understand your buyer feed is a tremendous data search, but I would guess closing would need a minimum of 30 days to find the buyer and give the buyer some time for close.

Do you feel your buyers feed is so powerful that you can find a buyer in 1 week and close in 1 week. Will lose earnest money if not close on the closing date

Thank you!

I think 30 days is a good minimum. If the seller’s desired time frame is shorter than that, then the heat is on, and the deal needs to be worth it.

Our Cash Buyer Data Feed is a very powerful tool and from it you’ll develop a list of buyers, known to you, that you can count on to take every good deal you have, without delay.

Don’t you already need a buyer in place in order to partake of your funding?

Wouldn’t having no contingencies except a clean title leave you vulnerable to a situation where there are structural issues that are severe enough to make the sale price unacceptable and those issues would be uncovered in an inspection? Wouldn’t having an inspection contingency give you the leverage to walk away or re-negotiate the price?

You’ll want to determine the condition and issues before making your offer. If there are significant issues that will keep you awake at night, then DO include a contingency.

Hi Cameron!

Your infos are pretty explicit about making an offer on a house. I have a better understanding of how this business needs to be done for success.